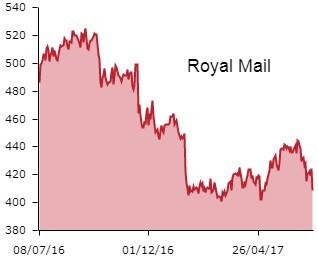

Parcels courier Royal Mail (RMG) is set for a difficult period of trading according to UBS, which has downgraded the stock to a ‘sell’.

Analyst Dominic Edridge believes Royal Mail's growth will continue to lag that of peers as the company has failed to modernise. He highlights its relatively high pricing for heavier parcels, due to the cost of manually sorting out packages, as an example of this.

In May, Shares flagged falling letter volumes of 6% as a concern, which the company blamed on ‘business uncertainty’. Royal Mail also warned that if these conditions continued, it expected this decline to go on.

Edridge thinks this has proved to be the case and expects ‘greater letter volume declines’ of 6% in both 2018 and 2019. ‘Unfortunately this period is coinciding with a slow UK economy, which is likely to mean weak retail sales and lower eCommerce growth’, says the analyst.

Royal Mail is not anticipated to be able to offset these headwinds, according to UBS. Edridge argues that 5% parcel growth in 2018 and 2019 is needed, yet his growth expectation for this division is a mere 1%.

Further risks to the UK delivery service include uncertainty over Royal Mail's pension and inflation, factors which could prompt industrial action and increase labour costs by 2.5% if left unresolved.

Shares in Royal Mail are 2.9% down to 412.2p. Earlier this week, we warned that the company is at risk of being booted from the FTSE 100.