- Sale of packaging business fetches £312 million

- Strategic review of filters business on track

- Active management talks on potential M&A component deals

Shares in support services business Essentra (ESNT) moved higher following the announcement of the sale of its packaging business for £312 million.

Management also confirmed that the strategic review of the filters business, also for sale, was progressing in line with expectations.

Essentra is is selling its packaging division to Austrian firm Mayr-Melnhof for £312 million.

Mayr-Melnhof has a market capitalisation of €3.2 billion, and the acquisition will enable it to grow its market share in the European pharma carton and secondary packaging segments.

The deal is expected to complete in the fourth quarter of this year.

Essentra will initially use the proceeds of the disposal to strengthen its balance sheet and make a small contribution to its defined benefit pension schemes.

The transaction value of £312 million implies a historic enterprise value to earnings before interest tax, depreciation and amortisation (EV/EBITDA) multiple of 12.4x.

ONE STEP CLOSER

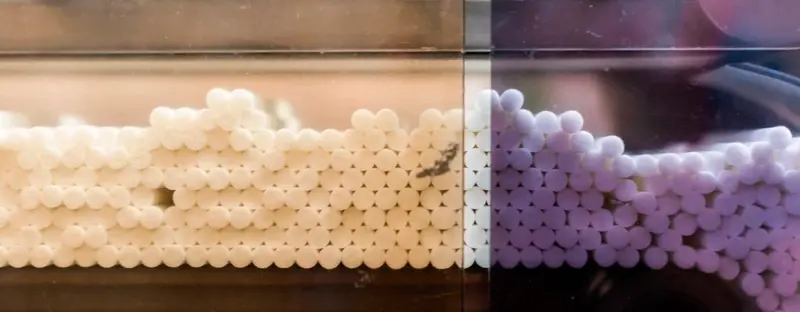

In October 2021, Essentra announced that intended to divest both its packaging and filters businesses.

Essentra’s packaging business has been successfully turned around, and today’s transaction reflects industry acknowledgement that it offers a focused business proposition in secondary healthcare packaging.

The disposal takes Essentra one step closer to becoming a standalone components business.

Key peers including Electrocomponents (ECM) and Diploma (DPLM) both trade at a clear premium to Essentra.

As a pure components play the firm will enjoy better growth, higher profitability, more customer diversification, stronger cash conversion and an improved return on capital employed, which should lead the shares to rerate.

At the same time, Essentra management is actively engaging in potential merger and acquisition activity to bolster the components business.

On a recent analyst conference call management confirmed that they were in active discussions with various parties and wre ‘bound by three non-disclosure agreements at present’.

LEARN MORE ABOUT ESSENTRA