News UK insurance industry guru Peter Wood is growing his stake in comparison site GoCompare (GOCO) is lighting a fire under its share price - up 6.8% to 69p.

Wood, the founder of Direct Line (DLG), Esure (ESUR) and Sheila’s Wheels, has been involved with GoCompare since its acquisition by Esure in 2014 and currently sits in the chairman’s seat.

Today’s stake building by Wood takes his holding from 25.6% to 29.9%, just short of the threshold at which he would have to make a full takeover offer, and is accompanied by comments that the ‘current Gocompare share price does not fully reflect the operational and strategic momentum in the business’.

It has certainly been a rough 12 months for GoCompare shares, which have nearly halved over the period thanks to fears over a possible competitive threat posed by Amazon plus factors such as the impact of falling motor premiums on the wider insurance market.

READ MORE ON GOCOMPARE HERE

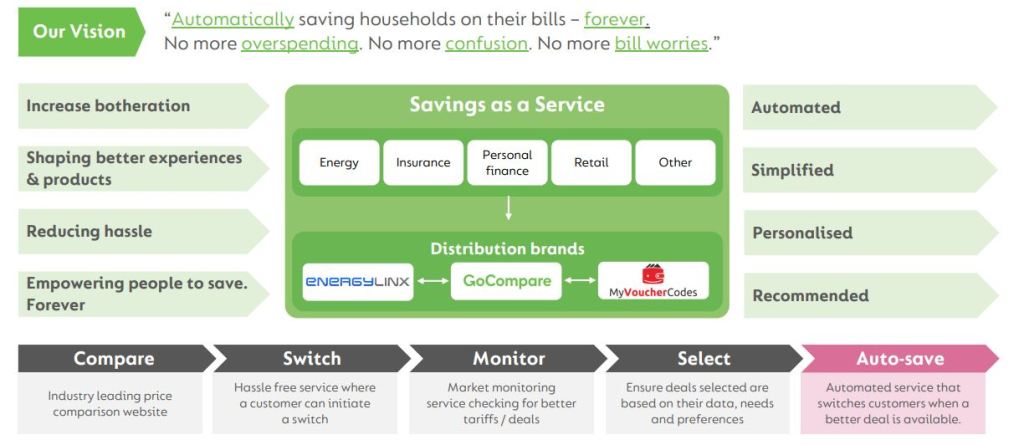

In highlighting the potential for GoCompare Wood namechecks its ‘Savings as a Service’ strategy and the company’s new weflip automated energy switching brand specifically.

Source: GoCompare

In a note published yesterday investment bank Berenberg spelled out what it believes weflip adds to the business. ‘We believe weflip could be transformative for GOCO as it: (1) addresses the underserved “infrequent switcher” user segment; (2) improves customer retention and switching rates, leading to higher user life-time value; (3) shifts the revenue model from one-off transactions to recurring switching revenue streams; and (4) reduces user acquisition/retention costs.’

AJ Bell investment director Russ Mould says: 'British entrepreneur Peter Wood is a man to watch when it comes to all things insurance.

'So when he declares that GoCompare is far too cheap and buys another big slug of the business, you know both industry professionals and investors are going to sit up and take notice.

'The fact that Wood has taken his stake to the highest possible level before having to make a full takeover offer, under listing rules, would suggest he is extremely bullish about GoCompare’s prospects.

‘The next question will be whether he wants to take the business private so it can concentrate on the day job without the distractions of being a public company. One cannot rule it out.’