Train operator Stagecoach (SGC) is the biggest riser in the FTSE 250, up 5.7% at 163.7p, after guiding for better than expected adjusted earnings per share in the year to 27 April 2019.

Earnings per share of 19.7p are expected compared to 18.5p in December.

Stagecoach, which operates the East Midlands rail franchise, says the financial performance of its rail division is ahead of expectations, flagging good underlying revenue trends.

READ MORE ABOUT STAGECOACH HERE

In the 44 weeks to 2 March, like-for-like sales growth in the UK Rail business (excluding Virgin Trains East Coast) rose 1.4%.

After reaching a good outcome from 'contractual matters' relating to the expired South West Trains franchise, Stagecoach also expects an undisclosed additional profit in the current financial year.

FOCUS ON ‘FLAWLESS EXECUTION’

In its bus division, Stagecoach is making encouraging progress by focusing on bus contracts that generate a financial return on the money invested.

‘The name of the game for Stagecoach is flawless execution and not allocating capital unless there is a good chance of making a positive return,’ comments AJ Bell investment director Russ Mould.

The transport operator is also making progress with disposing its embattled North American operations, which was previously announced in December.

Over the last year, the public transport sector has dominated headlines as some rail franchises underperformed.

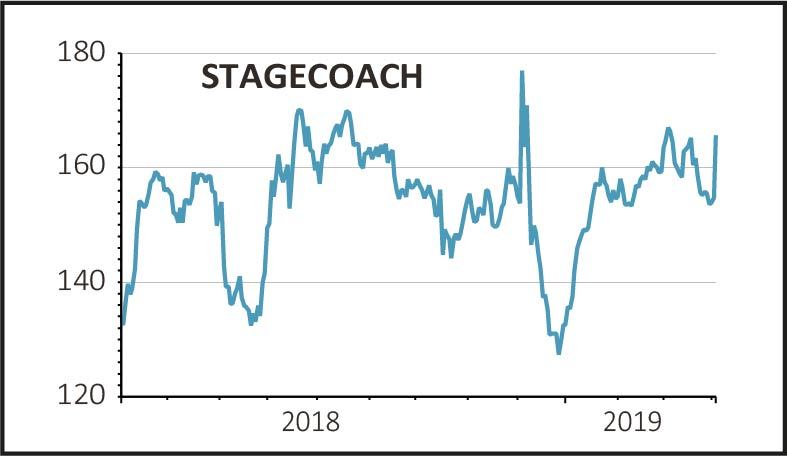

Yet shares in Stagecoach have accelerated 27.1% over this period as the firm has looked to improve its performance and focused on its UK operations.

‘Management are having to work hard to ensure the trimmed down business still makes money, clearly giving up the dream of mass scale in preference of making positive earnings from a smaller, more manageable base,’ says Mould.