Headline full year results from automotive fluid systems engineer TI Fluid Systems (TIFS) were always likely to be flattered by the absence of the IPO costs which affected 2017 numbers. Hence why pre-tax profit is up from $158m to $217.1m.

However, the market is impressed with the company eking out 2% revenue growth in a difficult market, particularly given this is backed up by a 23% increase in adjusted free cash flow which helps underpin a big hike in the dividend year-on-year from 1.31 euro cents to 8.96 euro cents.

The shares are up 8% to 185.5p in response, though they still trade a long way short of the 255p issue price from the October 2017 IPO.

READ MORE ABOUT TI FLUID SYSTEMS HERE

WHY HAD THE SHARE PRICE SLIPPED?

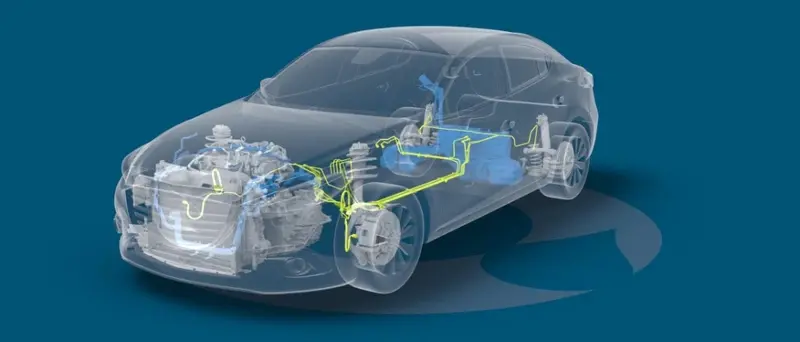

Investors had been worried about the company’s ability to maintain its position in the automotive market as it shifts towards electric vehicles (EVs) but the signs here are encouraging with positions secured on electric vehicle platforms in 2018 which could ultimately be worth around €700m.

Another key concern was the firm's exposure to a stalling global automotive industry, but the 2% growth in revenue was 3.1% above global light vehicle production growth volumes suggesting the group has the capacity to outperform in a softening market.

On the outlook, chief executive William Kozyra says: ‘The excellent progress delivered in executing our HEV and EV strategy in 2018 as well as our approach of continued and disciplined organic growth has positioned the group well for 2019 and beyond.’