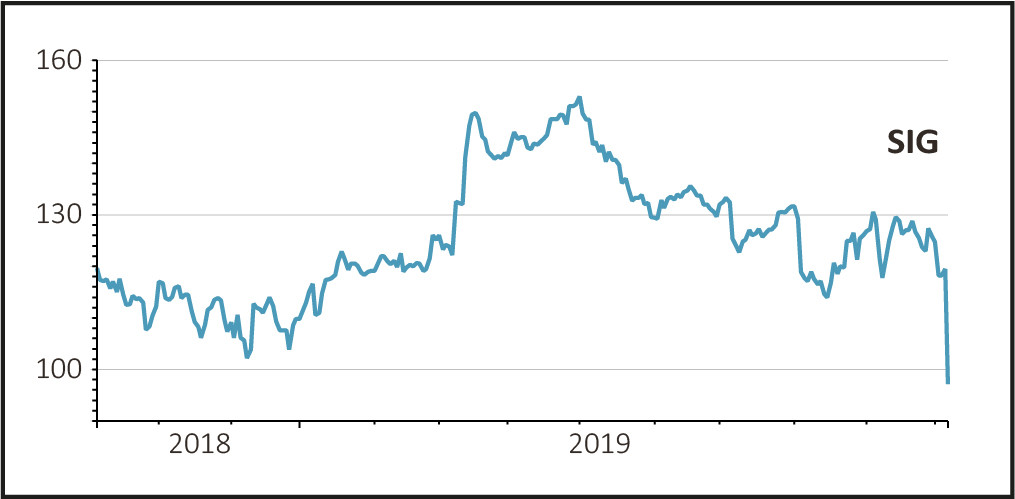

The latest profit alert from building products firm SIG (SHI) has sent the shares careering down 17.9% to 98.1p but should not have come as a major surprise to the market.

In July the company issued a downbeat first half trading update which maintained full year expectations with the telling caveat that it would continue to monitor how trading conditions develop.

Fair to say they’ve not developed well since then. To quote the company: ‘The recent further weakening of the trading backdrop as the group has entered its traditionally strongest trading months of the year means that the board is now anticipating, in both the specialist distribution and roofing merchanting businesses, significantly lower underlying profitability for the full year than its previous expectations.’

READ MORE ON SIG HERE

The economic background had notably weakened in the UK and Germany, it adds. ‘This deterioration in trading conditions has accelerated over recent weeks, and political and macro-economic uncertainty has continued to increase,’ it concludes.

TAKING ACTION

To be fair to management they are not just letting things slide. The company has agreed to sell its air handling division to France Air Management for €222.7m (£198.3m) including debt. Separately, it has also agreed to sell its building solutions unit to Ireland's Kingspan (KGP) for £37.5m.

The hope being that a refined focus can help the company get back on track.

AJ Bell investment director Russ Mould comments: ‘SIG has issued numerous profit warnings in the past few years as the UK construction market goes through a very difficult patch. Right-sizing its business now could be a sensible thing to do, particularly as it is managing to sell assets on decent valuation multiples.’

Shore Capital analyst Graeme Kyle says SIG’s warning is consistent with UK construction PMI data published over the last six months ‘and, we think, is a reflection of the political turmoil impacting construction project decisions in the UK’.