Some largely dovish words from US monetary policymakers supported equities, giving stocks in New York a decent start and sending shares in Europe to session highs before the close, though the dollar suffered.

The pound edged to only ever-so-slightly below the $1.27 mark, while the euro topped $1.10.

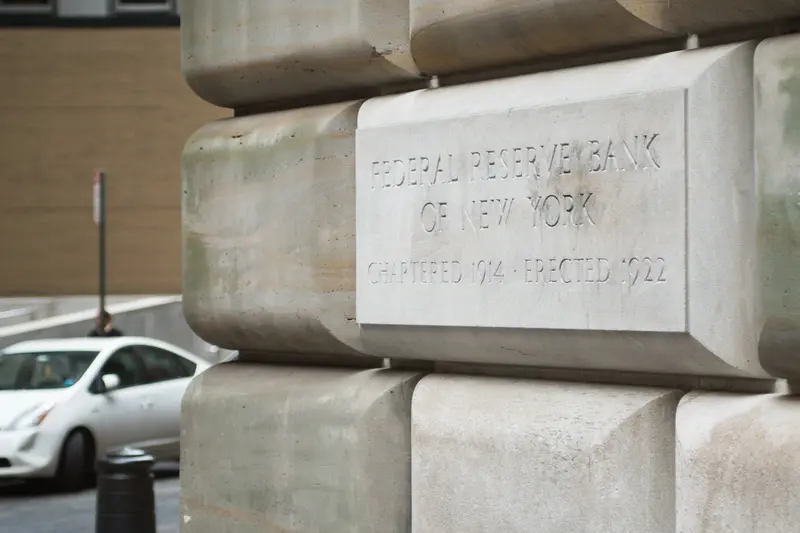

The comments from the Federal Reserve cemented the notion that the central bank has enacted its last US interest rate hike of the cycle. All eyes will be on whether US data this week, in the form of a gross domestic product reading as well as the Fed’s preferred inflation tracker, play ball. If they do, equities could be in for a strong end to a difficult year.

The FTSE 100 index closed down 5.46 points, 0.1%, at 7,455.24. The blue-chip index spent most of the day deeper in the red, and at one point it was 0.8% lower.

The FTSE 250 fell 51.55 points, 0.3%, at 18,387.00, though it also closed around a session high. The AIM All-Share fell 2.38 points, 0.3%, at 712.57.

The Cboe UK 100 fell 0.1% to 744.14, the Cboe UK 250 ended down 0.4% at 15,927.27, though the Cboe Small Companies climbed 0.3% to 13,462.12.

In European equities on Tuesday, the CAC 40 in Paris closed down 0.2%, while the DAX 40 in Frankfurt rose 0.2%.

In New York, the Dow Jones Industrial Average rose 0.4%, while the S&P 500 and Nasdaq Composite each added 0.2%.

The US Federal Reserve is making encouraging progress in the fight against inflation, a senior bank official said Tuesday, pointing to signs of slowing economic growth and easing price increases.

‘I am encouraged by what we have learned in the past few weeks – something appears to be giving, and it’s the pace of the economy,’ Fed Governor Christopher Waller told a conference in Washington, in prepared remarks.

Economic data from October ‘are consistent with the kind of moderating demand and easing price pressure that will help move inflation back to 2%,’ he added.

The strong economic growth of the first three quarters of the year appears to be slowing in the final quarter, Waller said, pointing to a decline in retail sales data for October.

The decline in spending in the interest rate-sensitive motor vehicles sector ‘may be evidence’ that the Fed’s monetary policy is having some effect, he explained.

Speaking shortly after Waller, fellow Fed Governor Michelle Bowman told a conference in Utah that there had been ‘significant progress on bringing inflation down, so far without impairing the strength of the labour market and economic activity.’

In prepared remarks, Bowman said she still expects the Fed will need to raise its benchmark lending rate again in order to keep policy sufficiently restrictive and return inflation to 2% ‘in a timely way.’

She qualified her remarks by saying she would be willing to back another hike if ‘the incoming data indicate that progress on inflation has stalled or is insufficient.’

Oxford Economics analyst Bernard Yaros commented: ‘We now think returning to the Federal Reserve’s 2% inflation target will be a smoother journey than expected in early 2023. Our more sanguine outlook is driven by signs of disinflation in the most important category of the core personal consumption expenditure deflator.

US inflation data takes centre-stage on Thursday. The latest core personal consumption expenditures index, which is the Fed’s preferred inflationary gauge, is expected to have grown 3.5% on-year in October, easing from a 3.7% climb in September.

Wednesday’s economic calendar has a German consumer price index reading at 1300 GMT, before a US gross domestic product reading at 1330 GMT.

The pound was quoted at $1.2689 late Tuesday afternoon, rising from $1.2604 at the London equities close on Monday. Sterling rose to as high as $1.2698, coming close to hitting $1.27 for the first time in roughly three months.

The euro traded at $1.0987, higher than $1.0931. The single currency spiked to $1.1001, roughly a three-and-a-half month high. Against the yen, the dollar was quoted at JP¥147.59, down versus JP¥148.97.

Gold was quoted at $2,037.08 an ounce late Tuesday, surging from $2,000.74 at the time of the London equities close on Monday. The precious metal is trading at its best level since May.

In London, Rolls-Royce shot up 6.2%, the best FTSE 100 performer.

The jet engine maker is eyeing an operating profit between £2.5 billion to £2.8 billion during a ’2027 timeframe‘. It also sizes up an operating margin between 13% and 15% and is aiming for free cash flow of £2.8 billion to £3.1 billion.

The London-based firm labelled the targets as a ’step change‘ in its financial performance.

‘We expect a progressive, but not necessarily linear, improvement year-on-year, and if we can accelerate the achievement of our ambitions we will,’ Rolls-Royce said.

The firm is also planning a divestment programme targeting £1.0 to £1.5 billion in proceeds over five years. It is looking to exit Rolls-Royce Electric in the short run or reduce its position to a minority stake in the electric aircraft arm, while pursuing a full exit down the line.

easyJet closed the best FTSE 250-listed performer, surging 4.9%.

The budget airline reinstated dividends as promised, alongside reporting a swing to annual profit, at 4.5 pence per share.

In the year to September 30, easyJet said revenue jumped to £8.17 billion from £5.77 billion a year before. It swung to a total pretax profit of £432 million from a loss of £208 million. It noted a ‘record’ performance in the summer, which it attributed to its recent initiatives, which helped to offset the hit from higher fuel costs and external operating challenges.

British Airways owner IAG rose 0.9% in a positive read-across.

Pets at Home shares climbed 2.3%. It reported lower profit in a half-year when it focused on transitioning stores to its new distribution centre in Stafford.

The Wilmslow, England-based pet supplies retailer said pretax profit declined 35% to £34.7 million in the 28 weeks to October 12 from £53.4 million a year prior.

Revenue rose 6.5% to £774.2 million from £727.2 million. Cost of sales increased 9.7% to £419.0 million from £382.1 million, while administrative expenses increased 9.6% to £248.6 million from £226.8 million.

The company maintained its interim dividend at 4.5 pence per share. It added that the first £25 million of its £50 million buyback programme has been completed, with the second £25 million tranche to start soon.

Elsewhere, there was some M&A action among smaller London listings.

Two China-focused investment trusts on Tuesday said they have agreed to combine to create a closed-end investment vehicle in London with £1.2 billion in assets.

Fidelity China Special Situations, a FTSE 250 index constituent, said it has agreed to merge with London Main Market-listed abrdn China Investment Co.

The merger will see the smaller trust, abrdn China, placed into voluntary liquidation, with assets and cash transferred to Fidelity China in exchange for new Fidelity China shares.

Fidelity China Special Situations shares rose 0.5%, while abrdn China Investment jumped 9.9%.

Investment firms Troy Income & Growth and STS Global also struck a merger deal. Troy Income added 1.2%, though STS fell 1.8%.

Both are managed by Troy Asset Management. STS Global has a ‘balanced portfolio constructed from global equities’, while Troy Income & Growth Trust ‘predominantly’ backs UK equities.

The firms said the combination, which has yet to be approved by the shareholders of either company, will be implemented through a scheme of reconstruction. Troy Income is to be liquidated and its assets transferred to STS. STS shares will then be issued to Troy Income shareholders.

Brent oil was trading at $81.77 a barrel late Tuesday, higher than $79.98 at the time of the European equities close on Monday.

The local corporate calendar has a trading statement from oil firm Harbour Energy, while water utility Pennon Group reports half-year results.

Copyright 2023 Alliance News Ltd. All Rights Reserved.