City of London-based red tape and risk management software supplier Lombard Risk Management (LRM:AIM) has for years been a tough call for investors to make. On the one hand, increasing compliance and regulations across the financial industry makes its target markets seemingly hot to trot. On the other, it's been that way for seemingly ages and still investors are left waiting for the meaningful breakthrough.

Full year figures to 31 March 2016 show that management made decent progress on the top line, with revenues up 10% to £23.7 million, but at some cost. Adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) more than halved to £2.1 million and there was (again!) significant cash burn of about £2.2 million, once £6.3 million of capex is netted off (including £5.8 million of capitalised R&D). The shares managed to nudge their way to 9.88p, a 2.6% gain.

Costs accelerated during the year including a rough 21% rise in technology expenditure to £9.1 million and there was a 12% rise in headcount to 317.

It's been about six months since new CEO Alastair Brown took charge (read our 'Red or black? Lombard gambles on Brown' story here) and part of his strategic rethink has seen Lombard concentrate on two core products; COLLINE for collateral management, AgileREPORTER for regulatory reporting, helping to stream line the sales function. But the company rhetoric around top line growth amid regulatory change-driven demand suggests that investors will continue to see profits growth capped in the near-term.

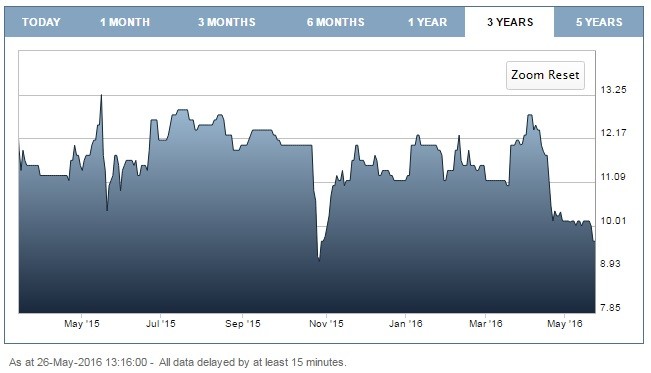

With around £3.3 million of net cash on the books, thanks to May 2015's £4 million cash call, there seems to be little immediate need for fresh funding but six months from now, who knows. Last May Lombard got the fresh funds with virtually no dilution (raised at 10.75p vs an 11p share price) although the stock had been at 13.25p just a week earlier.

If Brown and Lombard don't fancy tapping investors again, there's always the option to tap the bank manager. Time will tell.