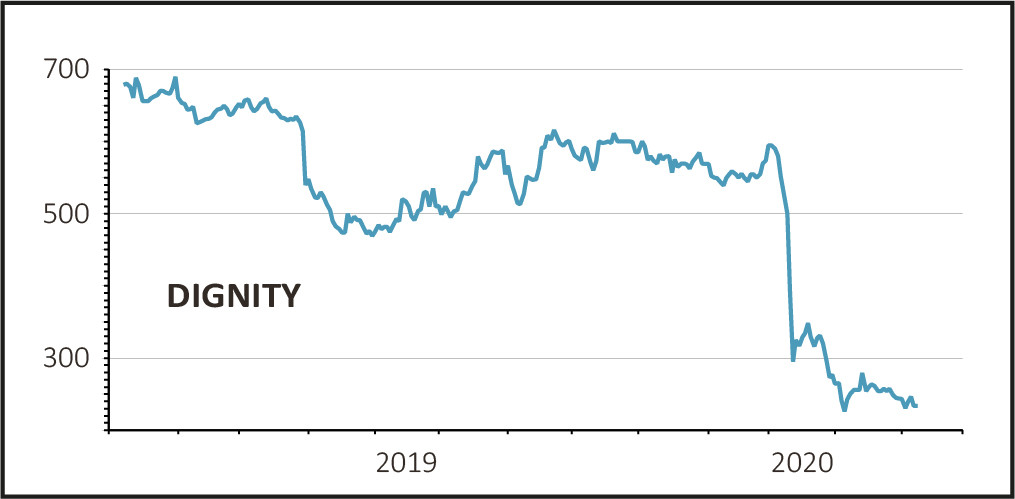

Shares in Dignity (DTY) rallied 4.9% to 245.5p on Monday after the troubled funeral services provider assured it has healthy cash balances to cope with the COVID crisis, the means to improve headroom against its banking covenants and that ‘liquidity remains robust for the time being’.

This enabled investors to look past a year-on-year drop in first quarter average income per funeral and a warning COVID-19’s impact has been more significant since the quarter end, with Dignity witnessing a dramatic rise in the proportion of bereaved clients choosing cheaper funerals in April.

COPING WITH COVID

Having paused its transformation plan, dividends and crematoria developments, Dignity today insisted that group liquidity remains robust, although management held off giving guidance for full year 2020 and beyond given the uncertainties that are out of their control.

In today’s COVID-19 update, Dignity reported a fall in profit on slightly higher revenue in the first quarter of 2020 following ‘some early operational impacts’ from the coronavirus pandemic.

Although Dignity performed 20,000 funerals in the first 13 weeks of the year, up from 19,200 in the first quarter of 2019 and representing a market share increase from 12% to 12.2%, underlying operating profit fell 11% to £19.4m in the quarter ended 27 March as income came under pressure.

A slide in average income per funeral from £2,904 to £2,823 reflected ‘the continued roll out of the group’s tailored funeral options, trials of different lower priced propositions, and the early impact of COVID-19’, explained Dignity.

Operations performed as expected for the crematoria business, although Dignity also saw a decline in memorial sales in March amid the COVID-19 lockdown.

PANDEMIC IMPACT WORSENS

In April, average income per funeral dropped further due to the temporary withdrawal of limousine provision for safety reasons, the halting of church services and a dramatic rise in the proportion of clients choosing a simple rather than a full service funeral.

‘Combining these impacts means the group is currently achieving an overall weighted average income per funeral before ancillary revenues of approximately £2,200 compared to £2,648 achieved in the first quarter of 2020’, added Dignity, still facing an ongoing Competition and Markets Authority (CMA) funeral market probe while pressing on with its search for a new chief executive.

Dignity also cautioned that because the UK has tragically witnessed more than 20,000 deaths in a single week since the end of the first quarter - the highest since the start of 2000 - it is possible that 2021 and 2022 could experience a lower number of deaths than in 2019.

‘COVID-19 is presenting a unique set of challenges for the UK as a whole and for Dignity,’ commented executive chairman Clive Whiley, who is ‘proud to be part of a business that has such an important role to play during this crisis.

‘I am particularly thankful to all our staff who have adapted quickly in these times of uncertainty to help our clients remember their loved ones in as personal a way as possible with the restrictions in place. They, together with all those working in the funeral industry, are an easily forgotten subset of key workers who all deserve our thanks.’