With a regulatory tsunami hitting beleaguered financial institutions, Lombard Risk Management (LRM:AIM) looks well placed to benefit from additional red tape.

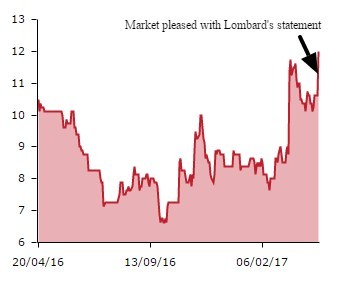

The firm’s share price shot-up almost 12% to 11.88p on a trading update, which research firm Equity Development describes as ‘phenomenal’.

Its expected revenues of between £34m-£34.4m exceeds analyst forecasts of around £31m.

Lombard’s chief executive Alastair Brown says when he took over the firm in December 2015 he envisioned a ‘two year journey’ which would need considerable cash to support.

The firm’s fund raising brought in £8m last year to spend money on its core software products; AgileReporter and AgileCollateral.

These products are key to the firm’s success. Although most banking clients prefer to not name their outsourcing firm, French giant Societe Generale chose Lombard’s collateral management package ‘Colline’ in March.

The plan

‘It’s a two year plan back to cash profitability because a lot of the money was paid upfront,’ Brown tells Shares.

Analysts did not expect Lombard to record a profit this year either but have significantly revised their forecasts upwards.

FinnCap’s estimates for this year are now a £1.6m loss, a fair way off its initial prediction of Lombard losing almost £4m for the year.

The firm’s cash position is expected to be £7m which again is well ahead of forecasts that put the figure around £1.4m.

This is impressive given the amount of investment the firm has made recently, including opening a development centre in Birmingham, previously based in Shanghai.

Keeping compliant

Lombard has to keep its clients on the right side of the Federal Reserve in the US, the Financial Conduct Authority in the UK and Monetary Authority in Singapore to name but a few regulators.

The news is awash with banks being fined for some regulatory mishap so you might expect Lombard to remain in demand for some time.

With the money spent developing the software platforms that can operate in any jurisdiction, it looks like cash well spent.

The firm also receives tailwinds from currency fluctuations as this brings greater demand for its collateral management packages needed by banks to mitigate risks.

Both the firm and analysts expect Lombard to be back in the black by next year.