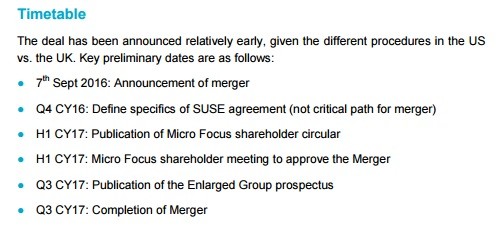

UK legacy infrastructure software company Micro Focus (MCRO) has agreed to merge with Hewlett Packard Enterprise (HPE), effectively its software arm in an $8.8 billion deal, or roughly £6.58 billion. The market loves the news, sparking a 15.5% hike in the share price to £22.58, an amazing reaction for a FTSE 100 company.

Here are some of the key details:

Enlarged group will stay listed in London, with American Depository Shares in New York. That's a real boon for UK IT which has seen many of its best companies cherry-picked by foreign buyers.

Cash back: Micro Focus existing shareholders will get a $400 million cash return from the deal, or about 130p a share.

A reverse takeover, HPE shareholders will own 50.1% of the combined entity on completion, existing Micro Fcus investors the other 49.9%.

The combined business will have revenues of $4.5 billion and EBITDA of $1.4 billion, before synergies.

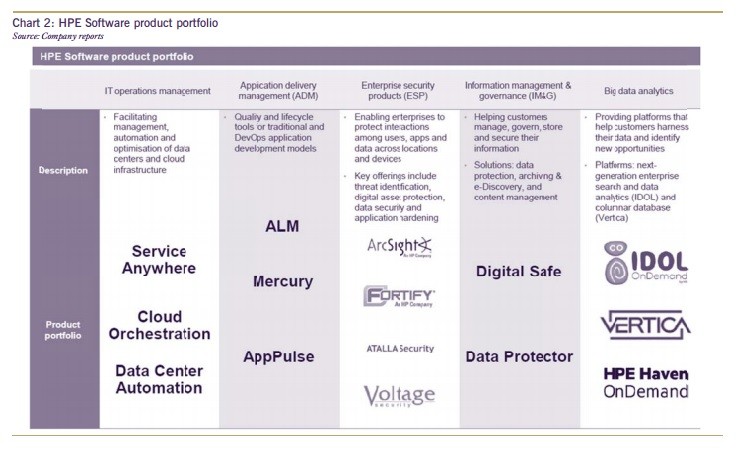

HPE’s software business operates in five main areas; IT operations management, application delivery management, cyber security, information management and data analytics. This includes Cambridge-founded Autonomy.

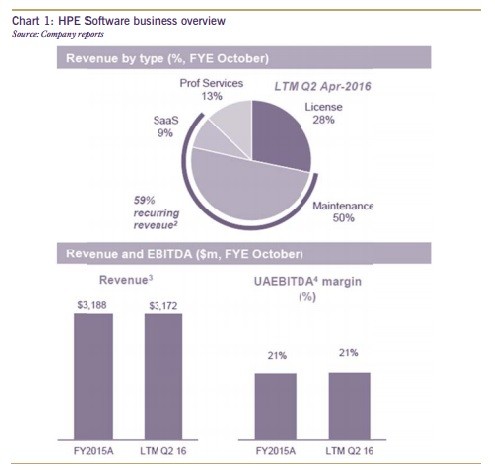

Revenues for the acquired businesses have been reasonably steady at $3.2 billion and margins are also stable at around 21%, giving EBITDA of $738 million in the last twelve months.

Kevin Loosemore will remain the boss, a man who's being doing IT asset sweating for years.

What's being said:

'One of the most interesting elements of the deal is that Micro Focus has been clear that it expects to be able to get the mature parts of the acquired businesses (80% of the total) up to the Micro Focus margin level (c46%) within three years of deal completion. This would mean that the combined entity would generate EBITDA of over $2bn in that time frame, assuming no material reduction in HPE Software revenues.'

Ian Spence, founder and chief analyst at Megabuyte

'HPE's Meg Whitman summed up the deal rationale very clearly on the HPE call - when asked how MCRO would be able to get such margin improvement she responded, “This is what Micro Focus does.”'

David Toms, technology analyst at Numis Securities

'We see the transaction as consistent with Micro Focus’ strategy of acquiring and efficiently managing sticky mature infrastructure assets.'

Paraag Amin, technology analyst at Peel Hunt

'A potentially strategically significant impact of this deal is that it creates a tight commercial relationship with HPE which we expect will remain an important sales and lead generation channel for some aspects of HPES. This will be extended to other areas of the portfolio, with the intent to enter a commercial partnership around SUSE also being announced today. This will position SUSE as HPE’s preferred Linux partner and explore additional collaboration around OpenStack.'

David Toms, technology analyst at Numis Securities