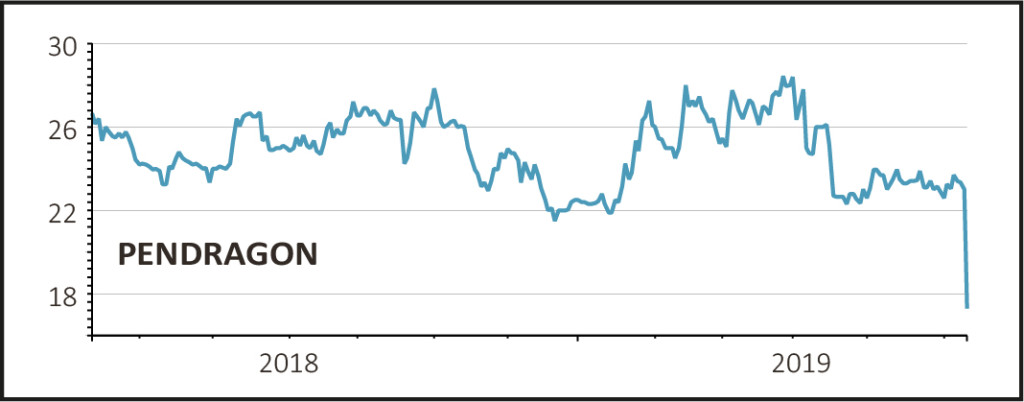

Another large dent has been put in the market value of Britain’s leading car retailer Pendragon (PDG), the shares skidding 25% lower to 17.4p on news it now expects to lurch into full year pre-tax losses.

Nottingham-headquartered Pendragon blames new car margin pressures, a tougher used car market and other factors for its latest earnings alert, one that mostly relates to the legacy of previous management.

And with new chief executive officer (CEO) Mark Herbert still working on his strategic review, Pendragon also unnerves investors by delaying its half year results from August to late September, when there could be further nasty surprises.

READ MORE ABOUT PENDRAGON HERE

For the uninitiated, automotive online retailer Pendragon represents a range of volume and premium car brands and is best known for its Evans Halshaw and Stratstone businesses.

Having carried out a review of the business, Pendragon’s newly appointed management is now guiding to a small underlying pre-tax loss in full year 2019. The news is crushingly disappointing for shareholders considering that Liberum Capital was looking for a £31.4m profit before today and the car retailer generated a £47.8m profit last year.

PEERING UNDER THE BONNET

The UK automotive retail market remains challenging, with the used car market seeing significant valuation declines and the Society of Motor Manufacturers and Traders (SMMT) reporting a 3.1% drop in new car registrations for the year to date to May.

Against this backcloth, Pendragon’s latest warning reflects the accelerated clearance of legacy used car stock through the second quarter, which will dent margins. A legacy of previous management, the retailer had too much used car stock at the end of 2018 which it needs to shift quickly. It also anticipates lower than expected new car margins and flags additional staff costs coming through on aftersales.

Herbert has also identified execution issues at Car Stores, Pendragon’s used car only business where losses are set to accelerate from £11.9m to a hefty £25m this year. Last but not least, 2019’s numbers won’t benefit from the one-off releases of balance sheet provisions which flattered profits in 2018.

One crumb of comfort is that Pendragon, in the midst of selling its US motor operations, hasn’t flagged up any banking covenant issues in today’s highly damaging statement.

HERBERT REMAINS HOPEFUL

‘Notwithstanding the challenging market and uncertain macro outlook, the expected loss for the year is still disappointing,’ concedes Herbert. ‘That said, we see significant addressable opportunities to improve the business and return to profitable growth’, says Herbert, also ‘confident there are real opportunities for self-help that will improve the performance of the core UK Motor and Leasing businesses.’

THE EXPERTS’ VIEW

Liberum Capital comments: ‘The tougher used car market had already been flagged by Lookers (LOOK), but we think that most of today’s downgrade is self-inflicted - a legacy of previous management. Given tough market conditions and the wide range of execution issues that need to be fixed, we think any recovery will be a difficult and slow process. Operational and financial gearing (including stocking loans) are high. The new management team has its work cut out.’

Russ Mould, investment director at AJ Bell, says ‘Pendragon has issued a car crash of a trading update. Guiding for its 2019 financial year to be loss-making, Pendragon is sitting on massive amounts of used car stock which it needs to offload. Margins are also lower than expected as it looks like prices are being slashed in order to hit volume targets. And costs are going up.

‘Businesses like Pendragon operate like a tread mill. They need to keep sales ticking over in order to maintain their health. If something bad happens, they fall off the tread mill and become unhealthy.

‘The used car market is highly competitive and Pendragon admits that it has been inefficient with how this part of its business has been run.

‘You need to consider that this is coming from a new management team, implying that strategic errors were the fault of the old team. Mark Herbert took over as CEO on 1 April, having joined from Jardine Matheson, and Mark Willis became CFO a week later.

‘They’ve done their review and are now laying out a plan to fix the business. Unfortunately market conditions are working against them and so it is likely to be a painful recovery.’