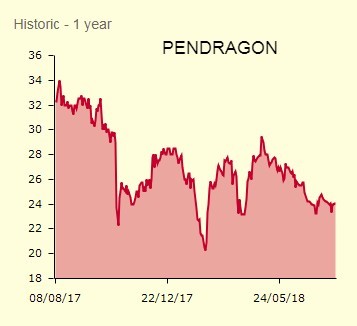

Car dealership Pendragon (PDG) decelerates 1.9% to 23.6p on weak first half results, reversing in with a 41.4% slump in underlying pre-tax profit (PBT) to £28.4m. Profits are down in its UK motoring division with margin pressure evident in used cars.

Yet CEO Trevor Finn seems surprisingly chipper, assuring 2018 profits will be ‘in line with expectations’, albeit downgraded ones, and expecting to deliver ‘an improved performance in the second half driven by an improving trend in used cars and new cars and further operating cost savings.’

Forecasts for the self-declared ‘leading automotive online retailer in the UK’ have been massaged down following a profit warning last October, where Pendragon blamed falling demand for new cars and a correction in used car prices for earnings disappointment.

Today, the Nottingham-headquartered motor retailer confirms profits remained under pressure in the half to June as fragile consumer confidence weighed on UK new car sales.

New car like-for-like sales were down 2.5%, although Pendragon outperformed the market, which was down 6.3% in the period. Used car like-for-like sales edged 0.5% lower with gross profit down due to margin pressure in the nearly new premium car markets.

SPEEDY ONLINE GROWTH

Encouragingly, Pendragon declares a 0.8p interim dividend, up from 0.75p year-on-year and expects to receive proceeds of more than £100m from the sale of its US business. Seasoned autos wheeler-dealer Finn is keen to highlight speedy growth in the Nottingham-headquartered concern’s online business.

‘We are gaining momentum as we lead the transformation to fully online used car retailing,’ insists Finn. ‘This will give us greater self-determination and deliver more reliable, sustainable earnings. Our industry leading software company gives us unique technology and expertise, to reformat our business model’, continues Finn, who is reallocating capital into higher return areas to drive shareholder value.

Visits to Pendragon’s Evanshalshaw.com and Stratstone.com sites were up materially in the half and Finn is ‘investing in further online capability and platforms to ensure we provide best in class service to our customers’.

Finn is excited by the potential of Pinewood, Pendragon’s high margin software business, which boasts strong recurring revenue and appears core to his strategic transformation plan.

PINEWOOD'S BRIGHTENING PICTURE

Pendragon has an objective to achieve at least double digit growth in revenue in Software as a Service (‘SaaS’) business Pinewood ‘for the foreseeable future’. Pinewood is fast becoming a global business with SaaS users in the UK, Ireland, Switzerland, Netherlands and Germany, as well as in South Africa, Namibia and Zimbabwe and in Hong Kong and the Philippines.

‘In the first half we have implemented SaaS licences into international customers with an addressable user base of over 1,200,’ says Pendragon, which claims to be ‘receiving substantial interest from a number of markets both from large dealer groups and from car manufacturers.'