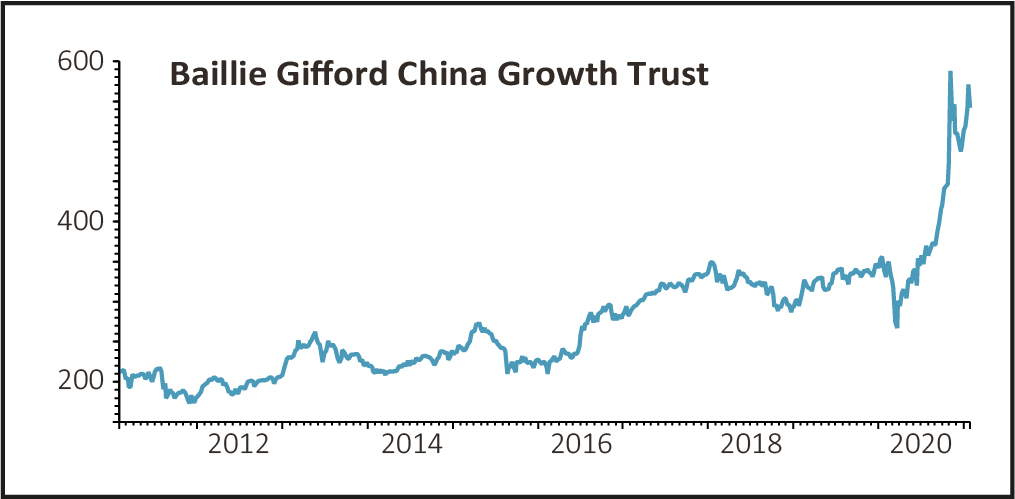

Baillie Gifford China Growth Trust (BGCG) is expected to take advantage of its soaring premium to NAV (net asset value) and raise fresh funding to sate the booming demand from retail investors.

The stock, down 2% today at 538.5p, is trading at an 11% premium to NAV, as massive reversal of its average 10.5% discount since Baillie Gifford took over running the old Witan Pacific last summer.

MASSIVE DEMAND

The investment trust has the scope to allot up to 20% of its shares in issue after renewing its authority in November last year. There are currently just short of 55 million available to trade, so it could up that total to around 66 million.

But Baillie Gifford China Growth believes that this may ‘not be sufficient to satisfy the continued demand for the company's shares’, said management.

‘It is envisaged that an equity raise would help satisfy further market demand and support the company's growth.’

CHINA’S EMERGING POWER

The World Bank has recognised China’s emergence as a world economic superpower as ‘one of the most important shifts in the global economy’. But experts say that this explosive growth over the past few decades has not been fully reflected in its stock market.

The Shanghai Composite has risen 32% to 3,505 since lows on March 2020, but that is less than half of the 70% rally of the S&P 500.

Source: Visual Capitalist

Source: Visual Capitalist

Having seen one of the fastest economic recoveries from the Covid pandemic, China has become one of the hot spots for investment in 2021, and beyond.

‘The next 40 years of global growth might be about the Chinese consumer’, former Goldman Sachs chief economist Jim O’Neill has said.