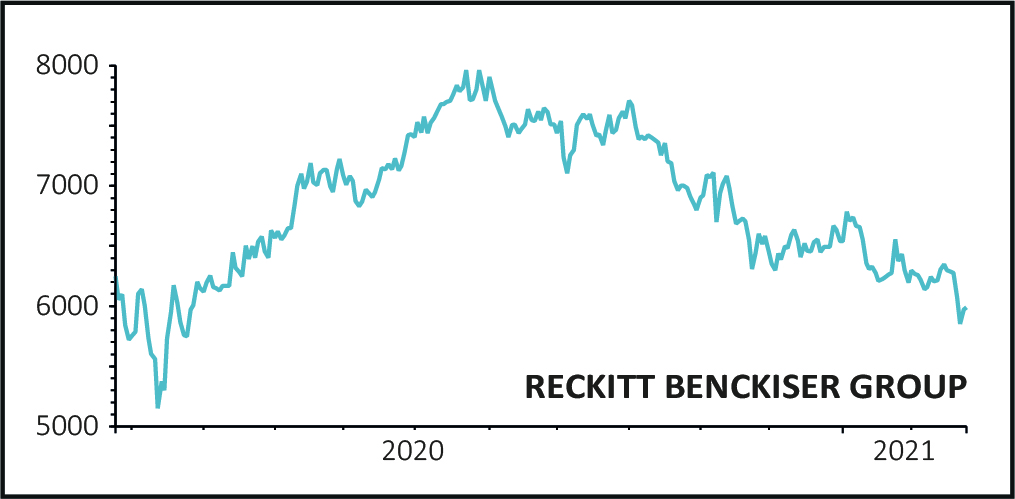

Shares in consumer goods giant Reckitt Benckiser (RB.) rose 1.1% to £60.38 on Wednesday as the Covid winner reported bumper 11.8% like-for-like sales growth to almost £14 billion for 2020, driven by a boom in sales of its Dettol and Lysol disinfectants.

However, Reckitt is fully aware that the highest annual sales growth rate in its history will be tough to beat and is forecasting significantly slower like-for-like sales growth of flat-to-2% for 2021.

Results for 2020 from Reckitt, the company behind health and hygiene brands including Dettol, Lysol, Finish, Durex and Nurofen, revealed operating profits of £2.16 billion, improved from a prior year loss of £1.95 billion as impairment charges fell.

Led by charismatic chief executive Laxman Narasimhan, Reckitt delivered record free cash flow generation of over £3 billion and kept the annual divided steady at 174.6p.

CLEANING UP

‘Our category-leading germ protection/disinfection brands have all seen substantial market growth, with around 80% of our consumers expecting to retain many of their new improved habits post pandemic,’ explained Narasimhan.

‘We capitalised on these new behaviours?with Dettol and Lysol entering?41 markets, with plans to enter a further 29 markets in 2021.’

AJ Bell investment director Russ Mould commented: ‘With the world’s attention firmly fixed on coming out of the pandemic and life returning to normal, Reckitt Benckiser will be praying that greater attention to cleanliness and hygiene seen over the past year won’t fade away.

SHARPENING THE FOCUS

Coming off the back of such strong sales momentum, Reckitt is taking the opportunity to sharpen its focus and position the portfolio towards higher growth brands and markets.

Its struggling China baby formula business is now under strategic review, while the Slough-headquartered company today announced the sale of its Scholl footcare brand to Yellow Wood Partners as well as the acquisition of the Biofreeze topical pain relief brand from Performance Health.

While Reckitt’s latest update triggered a positive market reaction, AJ Bell’s Mould says there is ‘still the lingering question of whether it can deliver sustainable growth over the longer term, particularly as competition is tough in many of its product areas.

‘Getting rid of the Chinese baby formula business would draw a line under one of the biggest mistakes in Reckitt’s history - namely overpaying for Mead Johnson in 2017 - and allow the business to shake off long-held criticism over the deal and shift the market’s attention to brighter parts of the group.’