Investors should be cheered that October is out of the way, according to fund managers at AXA Investment Management.

Slowing growth in Germany and China, rising geopolitical concerns in the Middle East, health risks posed by Ebola and richly-valued markets meant the sell-off in the month became self-fulfilling, says Alec Harper, client portfolio manager at AXA Rosenberg.

?Investors have a new-found understanding of the saying 'October is the cruellest month' as equity markets around the globe experienced sharp swings in performance and a marked uptick in volatility,? he says.

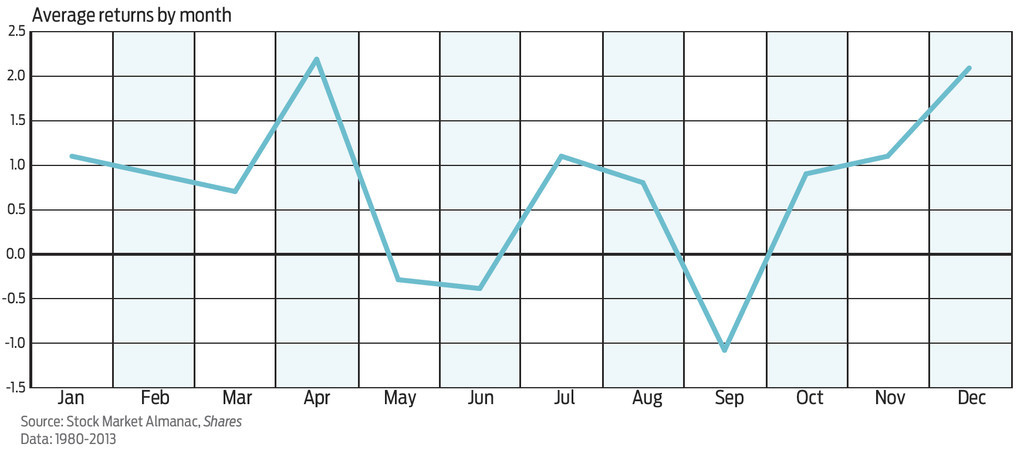

Observers of seasonality in the stock market point out that October is notoriously volatile. Its average return, at 0.9% over the last 33 years (see chart), is not bad. But October accounted for the biggest monthly decline on record in 1987, when the UK blue chip index fell 26%.

(Click on chart to enlarge)

According to a Forbes article, eight out of the 43 worst monthly declines in US history occurred in October. These included the crash of 1929, Black Monday in 1987 - the largest one-day fall in stock market history - and the financial crisis of 2008.

November, December and January tend to be better months in the UK stock market calendar. Data from the Stock Market Almanac shows these months have averaged 1.2%, 2.2% and 1.1% respectively over the last 34 years.

The best month for returns over that period is April, with an average of 2.2%. The old adage ?Sell in May and go away, don?t come back ?til St Leger Day? is borne out by the facts: Investors selling at the start of May and buying at the end of September miss out all of the months with negative average returns, which include May, June and September. But the effect has been weaker in recent years.

Harper warns investors should not try and time their buying and selling decisions. Selling in and out risks missing days when the market gains the most. AXA research shows that investors who were invested in the S&P 500 for the entire of 2009, right in the teeth of the financial crisis, would have earned a return of 26.5%. But, if they had missed the 10 biggest days of gains, they would have lost 16.9%. This, says Harper, is a good reason to stay invested through tough times.

?Timing rallies is hard and the best way to capture any potential upside from here may be to remain fully invested,? he adds.