Sporting goods giant Sports Direct International (SPD) has announced a possible 5p offer for ailing department store Debenhams (DEB) and offered to assist the embattled retailer ‘in addressing its immediate funding requirements’, with the latest twist in the bid saga sending shares in the embattled retailer surging 50% higher to 3.3p.

However, Sports Direct is only considering making a offer at this stage as a firm bid is conditional on Debenhams appointing retail industry maverick Mike Ashley (pictured below) as chief executive.

In addition, hard-pressed Debenhams would have to shelve refinancing plans already in place that would hand greater control of the company to lenders and wipe out shareholders.

ASHLEY TO ADD TO HIS EMPIRE?

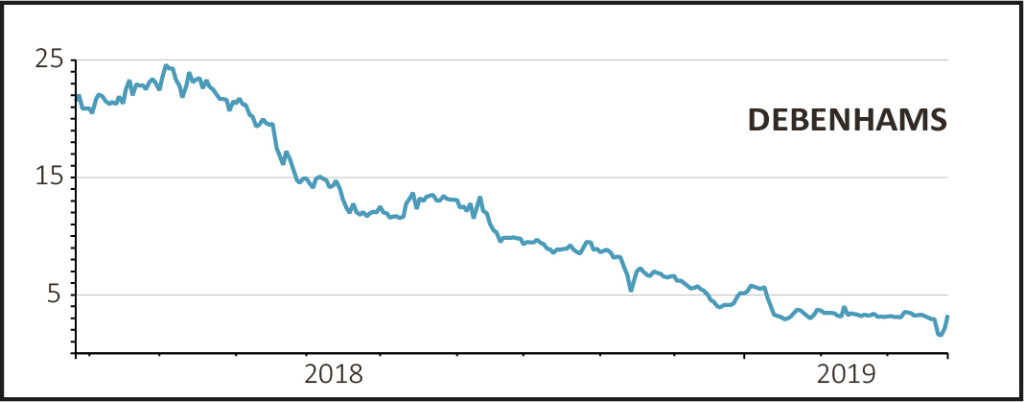

Valuing the heritage British high street brand at £61.4m, Sports Direct’s potential 5p offer looks generous in light of Debenhams’ bombed-out share price.

If made, this offer would represent a 127% premium to yesterday’s closing price, albeit this is a fraction of the 96p five-year share price peak.

Unorthodox billionaire Ashley, the owner of Newcastle United Football Club, has amassed a retail empire that includes House of Fraser, Evans Cycles, GAME Digital (GMD), French Connection (FCCN) and also Findel (FDL), whose board has rejected a 161p per share offer from Sports Direct.

Sports Direct bought Debenhams’ rival House of Fraser out of administration last year and has also been trying to wrest control of Debenhams, in which it is the largest shareholder with a near-30% stake.

Debenhams’ board is trying to raise up to £200m from existing lenders and has been resisting Sports Direct’s takeover attempts, but it has said any firm offer proposal from Ashley ‘will be given due consideration’.

FULL & FAIR VALUE?

Sports Direct says it believes that the possible offer would offer fair and full value for Debenhams.

It does not believe that Debenhams has the same value if it is handed over to its existing lender group.

Russ Mould, investment director at AJ Bell, says: ‘Sports Direct continues to dangle a carrot in front of Debenhams but it has yet to feed the horse. The latest episode in the retail soap opera is a 5p per share takeover proposal that comes with a big long list of conditions before it will make a proper bid.

‘Debenhams’ board is faced with a sticky situation. They clearly dislike Mike Ashley and his team yet any takeover proposal must be considered with shareholders’ interests at heart.

‘The business is in a very difficult position both financially and operationally and here we have a party which believes it has a solution to both issues.

‘Debenhams has sunk so far down into its hole that time is running out before it disappears altogether.

‘So far Debenhams has said that Sports Direct’s plan isn’t enough to address its immediate funding requirement so it looks like it will pursue a restructuring plan that will provide financial relief but wipe out shareholders.

‘But shareholders may consider that Sports Direct’s proposal could provide a huge difference as their investment would still be worth something. Debenhams really needs to put pride and ego to one side and have a proper conversation with Sports Direct about whether its proposal has merit or whether it can provide another solution.'