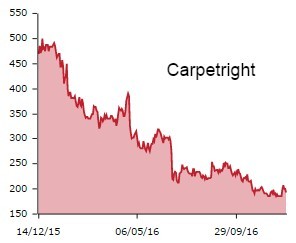

Floor coverings retailer Carpetright (CPR) has blamed unpredictable demand and volatile currency movements for its downbeat half year results, triggering a 5% decline in the stock to 190p.

This isn't the first time the firm has flagged these issues: it refused to change full year expectations in October.

Pre-tax profit was slashed from £7.1m to £4.1m despite a relatively modest 2.9% decline in like-for-like UK sales, showing the impact of high fixed costs in the business. Like-for-likes rose 3.7% in the first half of 2016.

Over all revenue fell 3.8% to £222.3m while net cash has plummeted by over £3.5m to £0.4m. At least like-for-like sales are improving, 2.6% ahead in the first six weeks of the second half.

Chief executive Wilf Walsh remains unsure about the full impact from the Brexit vote but it is clear that stiff competition is biting hard.

Broker Canaccord Genuity analyst Sanjay Vidyarthi says Carpetright needs to deliver a 33% pre-tax profit increase in its second half to meet mid-point consensus forecasts.

Vidyarthi believes improving like-for-like sales more recently are encouraging, but thinks an acceleration in turnover will be tough to achieve. The analyst retains a ‘sell’ recommendation on the shares.

Carpetright hopes a new brand identity and refurbishment programme will deliver sales growth with 49 UK stores currently adopting the brand. It plans to accelerate the programme to 150 stores by the end of the year.

Broker N+1 Singer analyst Matthew McEachran recognises that the retailer’s plan is addressing its key issues and is benefiting from early traction, despite the stock standing at a 20-year low.

Outside of the UK, like-for-like sales were 1.5% lower in local currency, but flags an improvement in underlying operating profit from £0.6m to £1.1m.