Instant-service equipment specialist Photo-Me International’s (PHTM) latest profit warning is blamed on Brexit-driven consumer uncertainty.

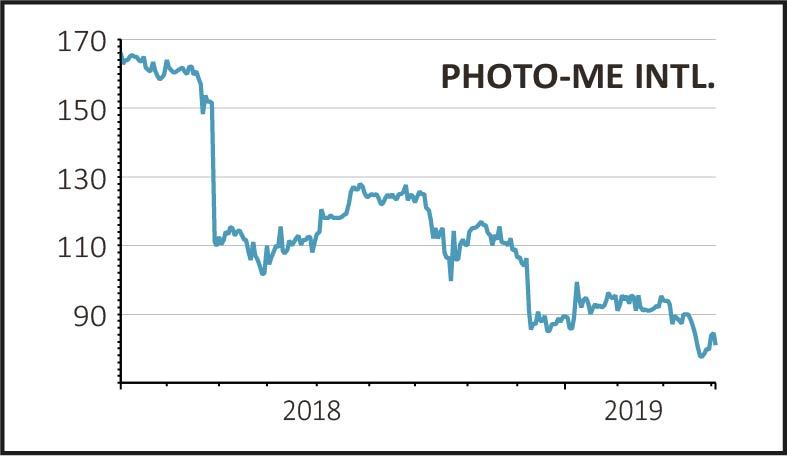

Shares in the Serge Crasnianski-steered concern cheapen 3.7% to 81.3p - they have fallen more than 57% from their January 2018 five year peak - on news which shouldn’t surprise Shares readers.

We’d already put you in the picture when we said the photobooths-to-laundry machines operator was softening investors up for another earnings alert with an opaque outlook statement in December.

READ MORE ABOUT PHOTO-ME HERE

In today’s update for the year ending 30 April 2019, Photo-Me warns pre-tax profit, net of restructuring costs in Japan, will be ‘slightly below’ previous guidance of £44m.

More specifically, profit should be ‘at least £42m’, down from the £46.8m generated in financial year 2018 and excluding any potential movements in the value of Photo-Me’s stake in Max Sight - an automatic ID photo booth operator listed in Hong Kong - between now and the end of this month.

BLAMING BREXIT

An internationally-diversified operator of digital printing kiosks, laundry units and amusement machines, Photo-Me warns UK trading has become more challenging than expected in the second half of the year ‘reflecting the slowdown in consumer activity as a result of continuing uncertainty around the UK's European Union exit negotiations’.

At the interim results in December, Photo-Me highlighted a delay in orders for its B2B machines revenue which it expected to be recovered during the second half.

Unfortunately, ‘due to the extended period of uncertainty in the UK, the group now does not expect to achieve a recovery in order levels before the end of the current financial year.’

Investors clued-up in terms of the coded language management teams often deploy will have spotted potential for further disappointments in December’s outlook statement, where Crasnianski cautioned: ‘The group’s ability to meet guidance remains subject to the economic environment, foreign exchange movements and consumer sentiment, which could affect performance.’

POSITIVE PROGRESS ELSEWHERE

Although the past few years have been tough with trading in the UK and France proving testing, there is still an encouraging longer term picture at Photo-Me. Highly cash generative, the company’s strategy to expand its high margin self-service laundry business, the primary growth driver going forwards, is paying off.

Photo-Me’s operations in Europe and Asia are growing in line with expectations and encouragingly, the strong performance from the restructured Japan business, whose previous problems lay behind a profit warning coughed up less than a year ago, has continued into this year’s second half.