Bonding materials specialist Scapa (SCPA:AIM) skips 7.2% higher to 396p as CEO Heejae Chae cheers with news sales, profits and margins beat expectations in the year to 31 March.

The Manchester-headquartered manufacturer of bonding products and adhesive components is prized for its consistent delivery of earnings upgrades.

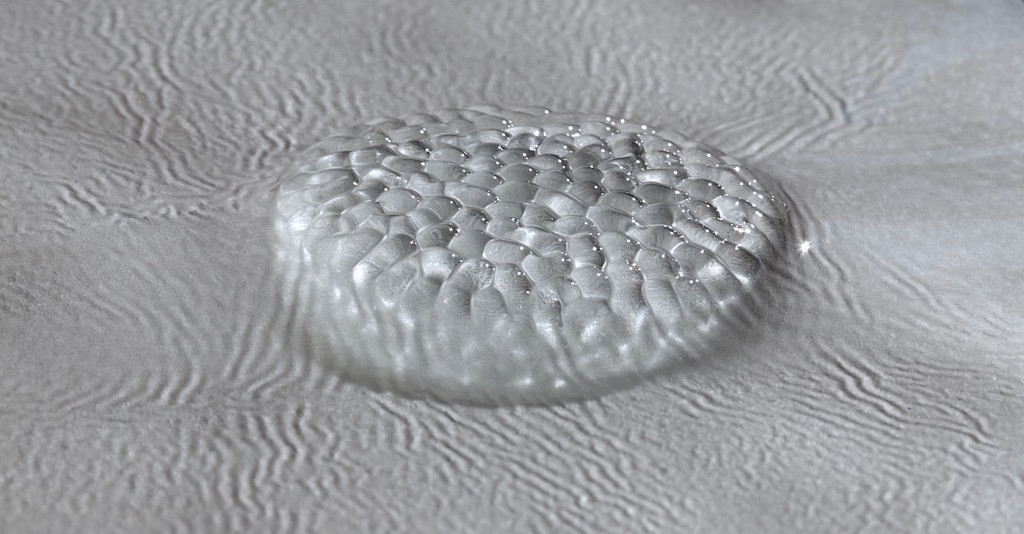

Scapa, whose products span skin-friendly adhesives for healthcare applications to lightweight adhesive tapes that improve industrial manufacturing processes, has forged a formidably strong track record which today’s update builds upon.

In a short year-end trading update, Scapa says the positive progress flagged at the half year stage has continued, with forthcoming full year results (23 May) set to beat earnings estimates.

IN RUDE HEALTH

Sales in its healthcare division, geared into the industry’s trend towards outsourcing, grew 16.5% with a helping hand from sterling’s weakness versus the US dollar and euro, as well as last May’s £28.3m acquisition of New York based wound care solutions business EuroMed.

Divisional margins strengthened in the second half, exceeding 15% for the year thanks to growth in higher margin products and the benefits of manufacturing efficiency measures.

‘With a strong pipeline of products coming online shortly and EuroMed integrating well, we would expect this business to strengthen in the coming year,’ writes Berenberg, a buyer with a 400p price target.

Over in Scapa’s Industrial division, ‘margin is expected to reach double digit for the year, driven by asset rationalisation and lower material costs’, enthuses Scapa.

‘We have delivered another set of strong results which are ahead of expectations as we continue to execute our strategies for Healthcare and Industrial,’ says Chae. ‘We remain confident of achieving further progress through organic growth, efficiency improvements and acquisitions.’

BERENBERG’S VIEW

‘While Scapa is just outside the top 10 in terms of market share, we believe its core competencies lie within the faster-growing areas, namely healthcare consumables,’ adds Berenberg, expecting ‘formal clarity on the magnitude of earnings upgrades to be given’ alongside next month’s results.

Based on Berenberg’s existing March 2018 earnings per share forecast of 14.8p, Scapa isn’t cheap on a prospective price-to-earnings ratio of 26.8 times.

Yet as Berenberg argues: ‘While at a headline level Scapa’s multiple of 25 times 2018’s estimated earnings appears expensive, if this business continues to drive material upgrades at each and every set of results, we believe the stock warrants its premium multiple.’

Competition and a slowdown in the automotive market are additional risk factors. ‘Scapa is smaller than its principal competitors (e.g. 3M, Nitto Denko and Tesa), which have considerably greater financial resources. Against these headwinds, Scapa must continue to innovate, strengthen its relationships with its key OEM customers and consolidate costs in order to maintain its market share.’

Automotive customers only account for roughly £30m of Scapa’s revenue. ‘However, this market is notoriously volatile and a sharp downturn would still create some disturbance to the group,’ warns Berenberg.