THIS IS AN ADVERTISING FEATURE

Authored by: Morgane Delledonne, Head of Investment Strategy, Europe

The equity market outlook for 2025 reflects the complex interplay of global macroeconomic conditions, evolving geopolitical dynamics, and sector-specific trends. While the US economy demonstrates resilience, challenges such as persistent inflation remain.1 Conversely, Europe faces structural hurdles which continue to weigh on growth, yet opportunities may be emerging in undervalued sectors, particularly infrastructure and nuclear energy, where fiscal support and policy initiatives could serve as catalysts for future growth.

PAINTING THE MACROECONOMIC PICTURE

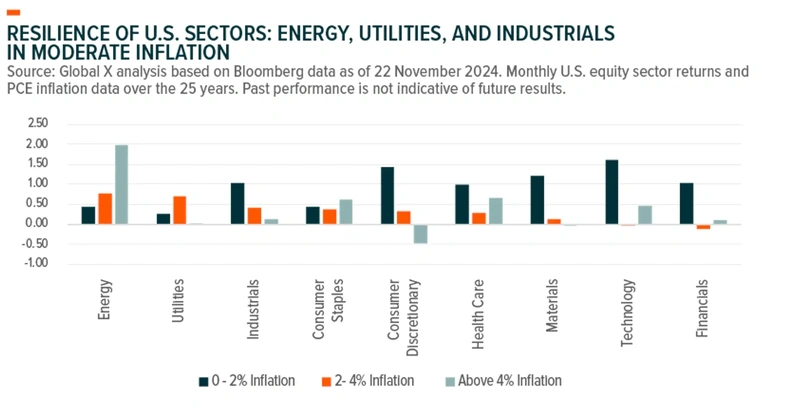

In the U.S., inflation could remain moderate in 2025, with markets anticipating two to three rate cuts amid a post-election surge in consumer and business sentiment.2 Following the resolution of election-based uncertainty, businesses may accelerate their capital spending on previously delayed projects if trends observed following Trump’s 2016 electoral victory are mirrored. Improved optimism surrounding regulatory and tax relief, and boosted investment demand, contributed to a significant rise in project activity by early 2017.

In Europe, growth faces external challenges. Chief amongst them is a slowing Chinese economy, a strong U.S. dollar, and capital outflows to U.S. equities. However, opportunities could emerge if undervalued equities gain appeal, and a weaker euro supports a potential rebound in exports. The European Central Bank’s anticipated rate cuts by mid-2025 could stimulate economic activity by significantly lowering borrowing costs for approximately €1.1 trillion in planned infrastructure projects, potentially providing a significant boost to GDP growth.3,4

With fiscal tailwinds and policy-driven initiatives, 2025 potentially offers growth opportunities in undervalued sectors like infrastructure and nuclear energy, despite global economic challenges.

REGIONAL INSIGHTS AND OPPORTUNITIES

In the U.S., bipartisan policies such as the Infrastructure Investment and Jobs Act (IIJA) and CHIPS Act could drive growth across both infrastructure and semiconductors.5 More than half of the IIJA’s $1.2 trillion funding remains currently unallocated, alongside $3 billion from the CHIPS Act, potentially offering investment opportunities here.6, 7 While proposed tariffs and stricter immigration policies could exacerbate labour shortages and inflation in sectors like manufacturing and construction, the evolving regulatory and trade landscape, under a Republican administration, may accelerate reindustrialisation efforts to mitigate potential supply shocks and strengthen domestic production.8

In Europe, the NextGenerationEU fund and the Cohesion Policy will look to drive progress across projects spanning renewable energy, digital transformation, and public-private partnerships. Notably, approximately 60% of the Recovery and Resilience Facility’s €723.8 billion budget remains unallocated, highlighting significant opportunities in infrastructure and clean energy projects, potentially including nuclear power. Additionally, the €392 billion Cohesion Policy funds continue to be distributed, further supporting regional development initiatives.9, 10

SECTOR-SPECIFIC OPPORTUNITIES

Defence Technology: Global defence spending is rising, driven by ongoing conflicts in Europe, the Middle East, and Asia. Germany, for instance, has met NATO’s 2% GDP defence spending target for the first time since the Cold War.11 This surge in defence budgets is seemingly fuelling growth in advanced military technologies, such as AI, cybersecurity, and autonomous systems.12 Shifting U.S. policies that prioritise modernised capabilities might further amplify this trend, although not guaranteed.

Infrastructure Development: Both the U.S. and Europe remain critical hubs for growth in infrastructure modernisation, semiconductor manufacturing, and energy transitions. If the Inflation Reduction Act (IRA) is repealed under the new administration, the remaining public funding would be available for allocation, potentially offering investors opportunities to target domestic industrial growth.13 In Europe, attractive valuations may present additional potential for investors with a value tilt.14 As the U.S. and Europe look to navigate these pivotal moments, regional differences in valuations and economic growth could shape investor preferences.

A STRATEGIC INVESTMENT APPROACH FOR 2025

In 2025, persistent inflation and fiscal pressures require careful portfolio construction. By focusing on diversification, forward-looking strategies, and risk management, investors can navigate this complex landscape.

- Target potential growth sectors such as defence technology, nuclear energy, and infrastructure development to align with possible long-term policy tailwinds.

- Possible diversification of the income theme through equity income with derivative strategies, which could help manage any volatility in bond markets amid uncertainty in the U.S. over its fiscal stance.

- Diversified strategies to mitigate risks associated with geopolitical and macroeconomic uncertainty.

NAVIGATING VOLATILITY: EQUITY INCOME AND DERIVATIVE STRATEGIES AMID TRADE POLICY SHIFTS (BY ALEXANDER ROLL)

Key takeaways:

- Proposed tariffs under the new U.S. administration could disrupt global supply chains, fuel inflation, and reintroduce market volatility reminiscent of the 2018 trade war

- Previous tariffs on solar panels, steel, and aluminium caused retaliatory measures and spiked the VIX to 37, underscoring the risks of protectionist policies

- Options-based equity income strategies and Structured options strategies are possible tools to potentially manage risk and enhance income in volatile markets, balancing downside protection with potential gains

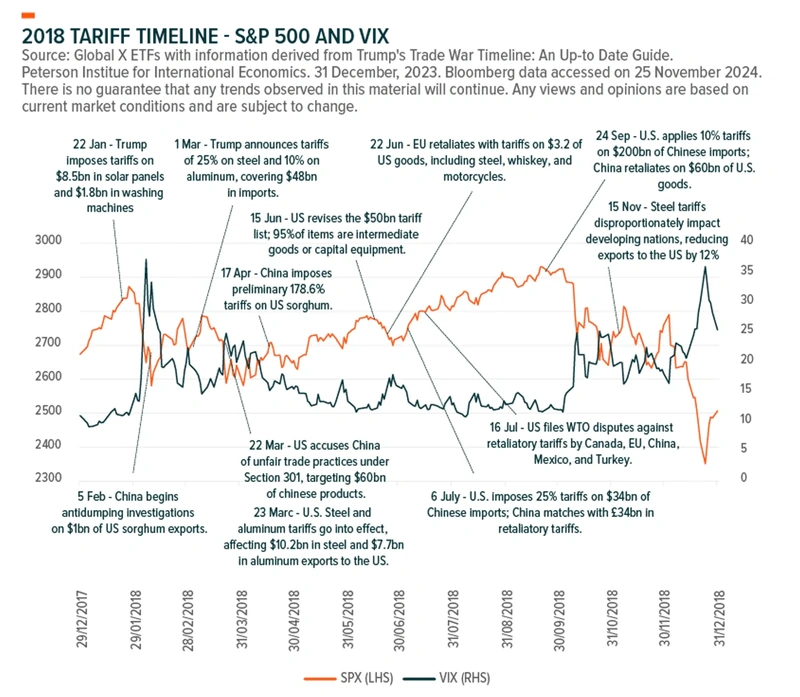

With the new administration set to take office in January 2025, speculation is rising over renewed trade tensions in the U.S. Proposed policies include tariffs of 25% on all imports from Canada and Mexico, additional levies on Chinese goods, and potential blanket tariffs of up to 20% on all imports.15 These measures, aimed at reshaping trade relationships, could carry the risk of fuelling inflation and disrupting global supply chains, potentially reintroducing market volatility reminiscent of the turbulence experienced during the 2018 trade war.

Historically, trade policies targeting solar panels, steel and aluminium led to significant tariffs on Chinese imports, prompting retaliatory measures and subsequent spiking market volatility.16,17 The CBOE Volatility Index (VIX), often called the “fear gauge”, surged to 37 at the height of those tensions.18 While these measures sought to address trade imbalances and support domestic industries, they served to highlight the delicate balance between protectionism and global economic stability.

In a volatile market, option-based equity income strategies could potentially manage risk and enhance income. Some derivative strategies may allow investors to monetise higher premiums during periods of elevated volatility, providing a potential income boost while offering some downside protection. Structured options strategies, on the other hand, can directly mitigate downside risk while maintaining some upside participation, potentially making them a valuable tool for navigating any market uncertainty.

THEMATIC SECTION

Key takeaways:

- U.S. manufacturing is experiencing growth, with semiconductor investments reaching $446 billion and construction surging 154% since the IIJA in 2021.

- Government incentives and private investments appear to be driving reindustrialisation, reshoring critical supply chains, and creating potential opportunities for infrastructure developers.

- Major capital expenditure on AI by hyperscalers highlights transformative growth potential across the AI value chain, from hardware to software innovators.

THE RESHORING RENAISSANCE: A CATALYST FOR U.S. MANUFACTURING? (BY ANDREW YE)

The reshoring of semiconductor manufacturing and broader reindustrialisation efforts could be key drivers of U.S. infrastructure growth. Private investment in semiconductors and electronics has already reached $446 billion as of November 2024,19 potentially fuelled by government incentives and a focus on addressing national security and supply chain concerns. This trend appears to be part of a broader surge in U.S. manufacturing construction, which has increased by 154% since the passage of the Infrastructure Investment and Jobs Act (IIJA) in November 2021, far outpacing the 24.3% growth in total construction.20 Over the longer term, manufacturing construction has increased 417.7%, since January 2010, reflecting sustained momentum.21 Looking ahead, policy focus to reindustrialise the U.S. and reshore critical supply chains could bolster manufacturing activity and unlock additional opportunities for infrastructure developers.22 These developments underscore the critical role of fiscal policies and private sector investment in driving transformative growth across U.S. industries.

Reshoring and reindustrialisation are driving transformative growth in U.S. manufacturing, with semiconductor investment surpassing $446 billion and construction surging 154% since 2021

ARTIFICIAL INTELLIGENCE: THE CAPEX SUPERCYCLE TO CONTINUES INTO 2025?

The continued growth of Artificial Intelligence (AI) is driving major capital expenditure (‘capex’) among hyperscalers (large-scale data centre operators that offer cloud computing and data solutions to businesses that require significant digital infrastructure, processing, and storage), with companies prioritising AI investments to capitalise on its transformative potential.23 While some believe the theme is still in the early stages, AI adoption is already showcasing its ability to potentially reduce costs, and unlock revenue and growth opportunities. 24

Investment in AI has predominantly focused on the build-out of the hardware layer, including chips, but the software layer is increasingly capturing value. Companies in industries such as customer relationship management (CRM) and creative industries are integrating generative AI functionality, potentially paving the way for enhanced productivity and customer engagement.25,26 For investors, the opportunities may lie in targeting the full AI value chain, from the hardware manufacturers that may benefit from any surging demand to software innovators leading adoption across sectors.

2025 METALS LANDSCAPE: SUPPLY RISKS AND GROWTH CATALYSTS (BY ROBERTA CASELLI)

Key takeaways:

- The uranium market appears set to potentially benefit from rising nuclear energy capacity, legislative support like the “Advance Act,” and supply chain shifts driven by geopolitical uncertainties.

- Copper demand remains resilient due to its critical role in renewables and AI infrastructure, and supply constraints and concentrate shortages may lead to market deficits in 2025.

- Precious metals may offer long-term appeal amid rising U.S. debt, inflation risks, and increased demand for silver in solar panels, supported by central bank accumulation and anticipated Fed rate cuts.

The uranium market appears to be potentially poised for growth in 2025, supported by increased nuclear energy capacity, supply concerns, and the push for energy independence.27, 28, 29 Outcomes from COP29 have reinforced commitments to expand nuclear energy, with the U.S. pledging to increase nuclear power capacity by 35 gigawatts over the next decade and a tripling by 2050.30, 31 Legislative support, including the bipartisan “Advance Act” (the Advanced Nuclear for Clean Energy), further accelerates the building of new reactors.32 Election risks may not hinder uranium’s momentum, and its growth could be further supported by increased energy consumption driven by the expansion of artificial intelligence.33 While geopolitical uncertainties, like restricted uranium exports from Russia, present supply risks, this could strengthen demand for Western uranium enrichment and conversion capacity, ensuring uranium remains a vital component of the global energy transition.34

With the U.S. pledging to triple nuclear power capacity by 2050 and AI-driven energy demand on the rise, uranium is cementing its role as a cornerstone of the global energy transition

Copper markets in 2025 could experience heightened volatility, largely driven by supply constraints and the ongoing demand from the energy transition and AI data centre infrastructure.35 Despite the threat of trade tariffs,36 the red metal’s essential role in renewables and AI-related technologies underpins its resilience.37 Acute concentrate shortages are anticipated to decrease refined capacity utilisation to 70% from 75%, leading to a possible deficit in the refined copper market.38 On the demand side, China’s policy support could play a critical role in stabilising the market, depending on the level and timing of its stimulus.39

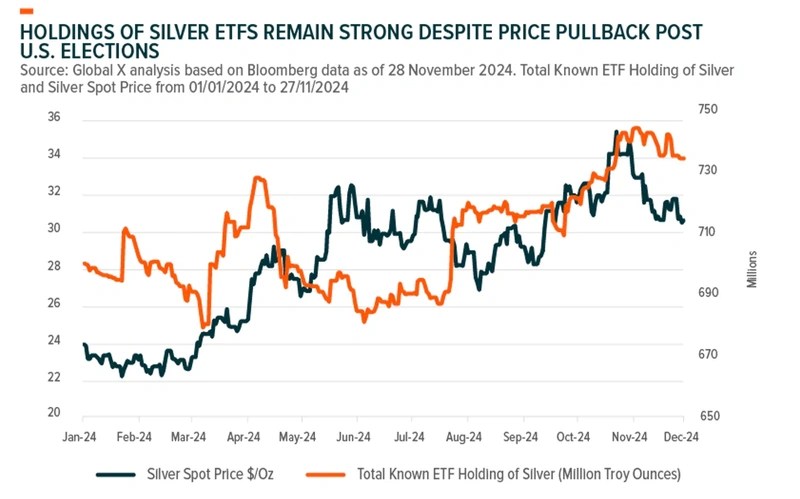

Despite the excellent performance so far in 2024, the strong dollar and higher U.S. yields caused gold and silver to react negatively following the U.S. election.40 Gold and silver are continuing to offer long-term appeal in 2025, bolstered by several factors, such as rising U.S. debt, inflation risks, and global uncertainty.41 Anticipated Federal Reserve rate cuts could lower the opportunity cost of holding these metals,42 while central banks may decrease their exposure to the U.S. dollar and maintain their accumulation of gold as a hedge against geopolitical risks.43 On the fundamental side, silver’s use in solar panels is projected to grow, potentially contributing to another market deficit.44 Despite, recent price volatility, exchange-traded funds holdings of silver have remained resilient, potentially signalling a bullish outlook for the year ahead.45

Footnotes

- Financial Times (25/11/2024), US and Europe diverge on monetary policy as Trump scrambles outlook

- Reuters (20/11/2024) Fed to lower rates in Dec but slow pace in 2025 on inflation risks: Reuters poll

- European Central Bank (17/10/2024), Monetary policy decisions

- Euronews (11/12/2024) ECB set to trim interest rates again: What’s next and why it matters

- Deloitte (4/11/2024) 2025 Engineering and Construction Industry Outlook

- Construction Dive (12/09/2024) $720B in IIJA funds yet to be allocated

- Tom’s Hardware (07/09/2024) Chipmakers race to get CHIPS Act dollars before White House changeover — TSMC and GlobalFoundries finalize applications, facilitating payouts

- Fox Business News (13/08/2023) US manufacturing sector reaping benefits of reshoring

- European Commission (23/02/2024) NextGenerationEU

- European Commission (02/12/2024) Available budget of Cohesion Policy 2021-2027

- Reuters (14/02/2024) Germany hits 2% NATO spending target for first time since end of Cold War

- Market Watch (25/11/2024) Defense IT Spending Market to Grow by USD 23.53 Billion (2024-2028), Driven by Autonomous Systems Development, Market Evolution Powered by AI - Technavio

- Fastmarkets (7/11/2024) Inflation Reduction Act in focus in Trump presidency

- Invesco (07/10/2024) Why European equities are attractively valued

- Financial Times (26/11/2024) Donald Trump says he will hit China, Canada and Mexico with new tariffs

- Ibid.

- Peterson Institute for International Economics (31/12/2023) Trump’s Trade War Timeline: An Up-to Date Guide

- Global X ETFs with information derived from Bloomberg Terminal. VIX Price data. Accessed on 25 November 2024.

- US Census Bureau (accessed 26/11/2024) Construction Spending – Data

- Ibid.

- Bain & Company (13/12/2024) Businesses accelerate reshoring and near-shoring amid heightened geopolitical uncertainties and rising costs, Bain & Company finds

- Microsoft, Amazon and Alphabet Earnings Call Transcripts, n.d..

- McKinsey (05/2024) The state of AI in early 2024: Gen AI adoption spikes and starts to generate value

- Salesforce (07/03/2023) Salesforce Announces Einstein GPT, the World’s First Generative AI for CRM

- Salesforce (Q2, 2025) Salesforce Earnings Call Transcript

- International Atomic Energy Agency (18/11/2024) Nuclear Power in the COP29 Spotlight as Countries and Companies Eye Climate Solutions

- World Nuclear News (18/11/2024) Russia places ‘tit-for-tat’ ban on US uranium exports

- EIA (1/10/2024) Data center owners turn to nuclear as potential electricity source

- International Atomic Energy Agency (18/11/2024) Nuclear Power in the COP29 Spotlight as Countries and Companies Eye Climate Solutions

- Ibid.

- US Senate Committee on Environment & Public Works (9/07/2024) SIGNED: Bipartisan ADVANCE Act to Boost Nuclear Energy Now Law

- Ibid.

- Ibid.

- Morningstar (15/11/2024) Is Copper Entering a New Supercycle?

- Reuters (28/11/2024) China’s scrap copper imports set to slump over US trade worries, analysts say

- Ibid.

- Bloomberg (14/11/2024) Global Copper Smelters to Cut Runs to 70% on Short Supply: CRU

- Ibid.

- Bloomberg data as of 28/11/2024. Gold and Silver Spot price from 01/01/2024 to 27/11/2024.

- Reuters (6/11/2024) US fiscal strain looms as key challenge for newly elected Trump

- Reuters (20/11/2024) Fed to lower rates in Dec but slow pace in 2025 on inflation risks: Reuters poll

- Bloomberg UK (15/10/2024) Central Bankers Make Rare Comments in Favor of Bigger Gold Stash

- The Silver Institute (17/04/2024) World Silver Survey 2024

- Ibid.

- Bloomberg (22/11/2024) Silver’s Solid ETFs Suggest Prices Can Stage a Fightback

THIS IS A MARKETING COMMUNICATION.

Please refer to the prospectus, supplemental prospectus and KID (Key Information Document) of the relevant UCITS fund before making any final investment decisions.

The value of an investment may go down as well as up and past performance is not a reliable indicator of future performance.

Trading may not be suitable for all types of investors as they carry a high degree of risk. You may lose all of your initial investment. Only speculate with money you can afford to lose.

Changes in exchange rates may also cause your investment to go up or down in value.

Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

Please ensure that you fully understand the risks involved. If in any doubt, please seek independent financial advice. Investors should refer to the section entitled “Risk Factors” in the relevant prospectus for further details of these and other risks associated with an investment in the securities offered by the Issuer.

This information is not intended to be, nor does it constitute, investment research.

These insights are strictly for general information purposes provided at the date of publication and may change without notice and are not a recommendation, solicitation or offer to buy or sell any financial products or to adopt any approach to investment. There is no guarantee that any matter discussed will be successful. Reliance on any part of this information is at your own discretion.

This information may provide estimates and future forecasts and are not a representation of any future performance. This information is not complete or exhaustive and we make no representations or warranties, express or implied, concerning the accuracy or comprehensiveness of these insights.

These insights do not take into account a person’s own financial position or circumstances of any person or entity in any region or jurisdiction. This information should not be relied upon as a primary basis for any investment decision. Its applicability will depend on the particular circumstances of each investor.

This information does not constitute tax advice and investors and potential investors are advised to consult their professional advisors concerning possible taxation or other consequences of purchasing, holding, selling, converting or otherwise disposing of any investments under the laws of the relevant region and/or their country of incorporation, establishment, citizenship, residence or domicile, or other liability to tax and in light of their particular circumstances.

Past performance is no indication of current or future performance. The performance data does not take account of the commissions and costs incurred on the issue and redemption of units.

Communications issued in the European Union relating to Global X UCITS ETFs are issued by Global X Management Company (Europe) Limited (“GXM Europe”) acting in its capacity as management company of Global X ETFs ICAV. GXM Europe is authorised and regulated by the Central Bank of Ireland. GXM Europe is registered in Ireland with registration number 711633.

Communications issued in the United Kingdom and Switzerland in relation to Global X UCITS ETFs are issued by Global X Management Company (UK) Limited (“GXM UK”), which is authorised and regulated by the Financial Conduct Authority. The registered office of GXM UK is 77 Coleman Street, London, EC2R 5BJ, UK. Information about us can be found on the Financial Services Register (register number 965081)