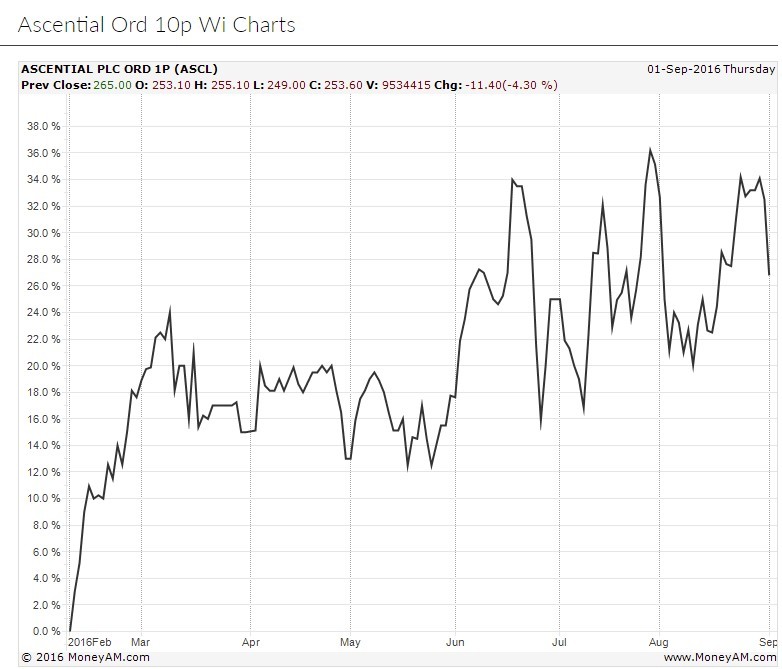

Events business Ascential (ASCL) is down 4.4% to 253.4p as its former owners, Apax Partners and Guardian Media Group, offload £200 million worth of stock.

The major shareholders will sell 80 million shares, representing 20% of the issued share capital, at a price of 250p per share and thus lose their representation on the board.

Peel Hunt analysts note the placing had been ‘widely anticipated’ and add the level of support from institutions is ‘pleasing’.

The events firm and brains behind the high-profile Cannes Lions advertising festival (pictured) was acquired by private equity house Apax and Guardian Media Group for £1 billion in 2008 when it was called Emap. The company joined the market through an IPO in February.

It is made up of two divisions: Exhibitions & Festivals which accounts for a little under half of its revenue and nearly 60% of group EBITDA; and the largely subscription-based Information Services which accounts for the remainder.

This news follows on from last week’s announcement of the $44 million acquisition of e-commerce analytics provider One Click Retail. In response to this deal Numis upped earnings forecasts, increased its price target to 350p and reiterated its ‘buy’ recommendation.

The broker added: ‘We view the transaction as an excellent strategic fit given management experience and sector expertise, and believe the financial structure is appropriate for a high-growth business.’