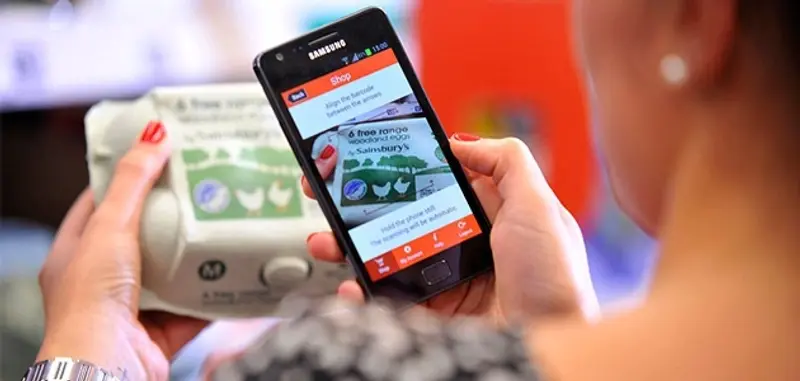

Hot technology like digital coupons is an area you'd expect US tech giants to dominate so it's great that London-listed Eagle Eye Solutions (EYE:AIM) is growing rapidly again in this niche.

Today's trading update shows revenue grew 74% in the three months to 30 September, better than the 65% analysts had pencilled in. Revenues in the period totalled £2.3m.

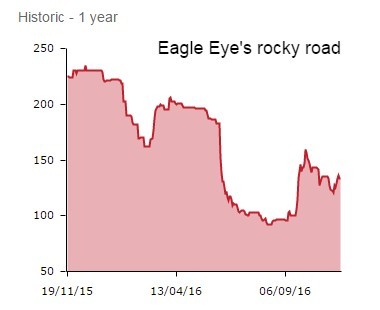

That's a timely bounce after last year's drag as big contracts were delayed by slowing brand campaigns at key fast moving consumer goods (FMCG) customers. Investors are still reluctant to give Eagle Eye and chief executive Tim Mason the benefit of the doubt given problems earlier this year: today's flat share price is flat at 133p, valuing the business at £28m.

Eagle Eye’s AIR platform, which delivers marketing messaging at retail point of sale terminals, is behind the rise, up 105% to £1.9m. Subscription fees and transactions over the network generated 71% (2016: 85%) of revenue. Net cash stands at £0.2m, that's roughly in-line with expectations.

For this young and still loss-making business, it may mean investors will be called on again to provide more funding, although it's worth remembering that the company agreed new banking facilities with Barclays in June.

For the full year to 30 June 2017, consensus revenue estimates are £10.7m, a gain of two-thirds on the same period in 2016. That implies a loss before interest, tax and non-cash charges (EBITDA) of £1.3m.

A move into profitability is expected by analysts at investment bank Investec the year after. Current estimates indicate £1.5m of EBITDA in 2018 on £15.4m revenues.

'Customers continue to grow, there is strong momentum in its AIR platform, and overall, management are confident that it is in good position to achieve half year expectations,' points out Megabuyte analyst John McCaul.