- Stock wiped out two months of progress in a day

- Believes it can triple revenues over next five years

- Analyst tells clients to ‘buy more’ in note

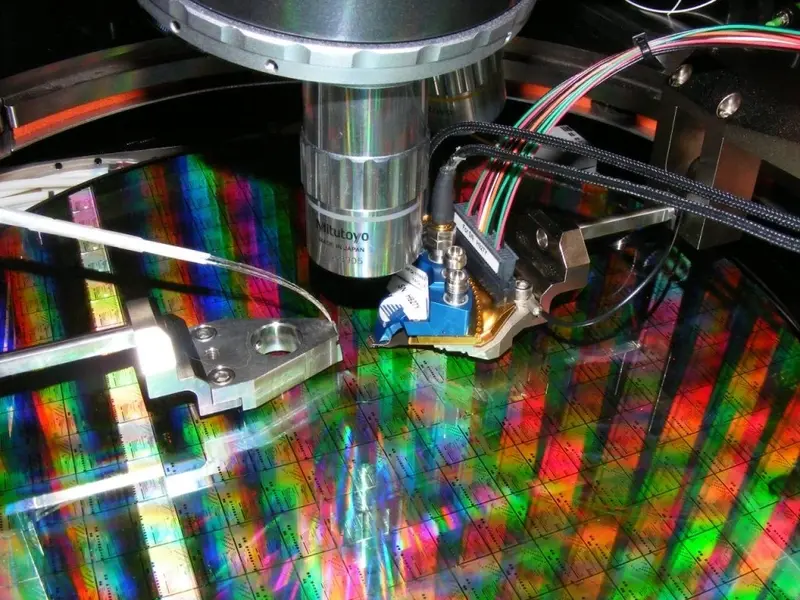

Shares in IQE (IQE:AIM) took a pounding in early trading on 16 January 2023 after admitting that it sees demand from existing clients slowing in the first half of this year as the clients destock current inventory.

The compound wafer supplier to the semiconductor industry saw its stock slump close to 20%, falling to 48.85p. IQE expects its constant currency revenues for the year to 31 December 2022 to align with2021 revenues, which came in at £154.1 million.

IQE expressed confidence in its diversification strategy and long-term growth targets. The company noted that it had made significant commercial progress in 2022 and would be building on a solid foundation this year.

Analysts largely agreed, with Numis telling clients to buy more shares on further weakness. ‘In short, growth prospects of IQE’s markets (wireless, photonics, microLED and power electronics) remain strong, and IQE is striking numerous deals to monetise all this opportunity over several years,’ the broker said.

LONG-RUN GROWTH AMBITIONS UNDIMINISHED

IQE held a Capital Markets Day on 9 November 2022 to update stakeholders on its future growth targets. Highlights included the company’s new principles, which are to be guided by the markets, capturing value for what it does and scaling and growing its business. The principles might sound vague because they act like guideposts.

IQE unveiled a plan to deliver solutions to its customers that connect, sense, power and display across three market segments. The three growth markets identified include communications infrastructure, smart connected devices and automotive and industrial applications.

The company wants to tap into the expected 22% average annual growth being forecasts for the global semiconductor epiwafer market, worth about $4.6 billion. The firm will continue focusing on its existing wireless and photonics markets while diversifying into the microLED displays and power electronics markets.

IQE plans to triple its expected 2022 revenue over the next five years with target revenues of $650 million by 2027. IQE shares have risen since holding the investor day, but today’s announcement erased almost all the gains made over the past two months.