Despite better than expected results and no visible exposure to the coronavirus, marine engineer James Fisher & Sons (FSJ) still found itself caught up in the market sell-off on Thursday.

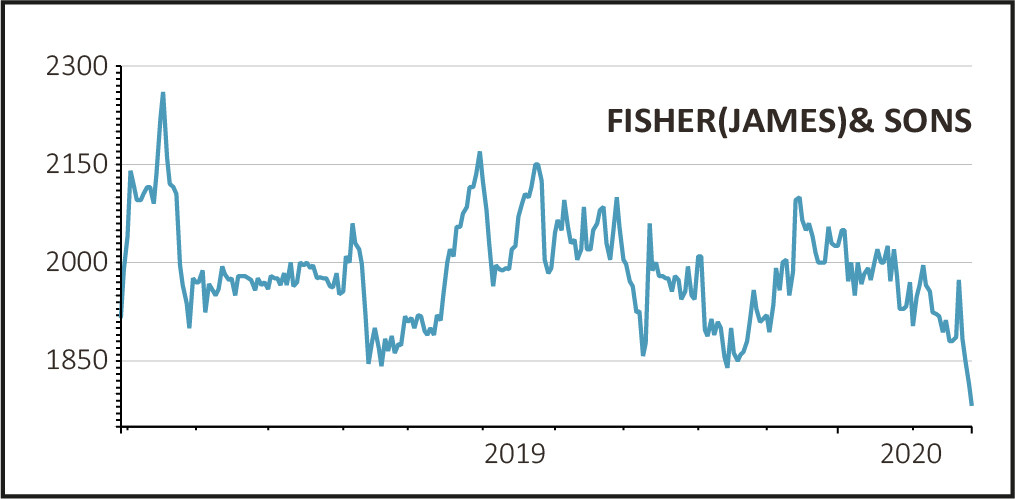

Shares in the FTSE 250 company dropped 1.4% to £17.88 even though full year earnings were ahead of analyst expectations across the board.

For the year to 31 December, the firm reported a 10% jump in revenue to £617m, a 7% rise in underlying operating profit to £66.3m, and a 4% increase in underlying diluted earnings per share to 92.8p, all better than the market was expecting.

However, reported pre-tax profit fell to £47.8m from £55.4m, while underlying operating margins reduced by 0.3% to 10.7% mainly due to an issue in its marine support division, which reported a slight drop in underlying operating profit and margin despite growing revenues.

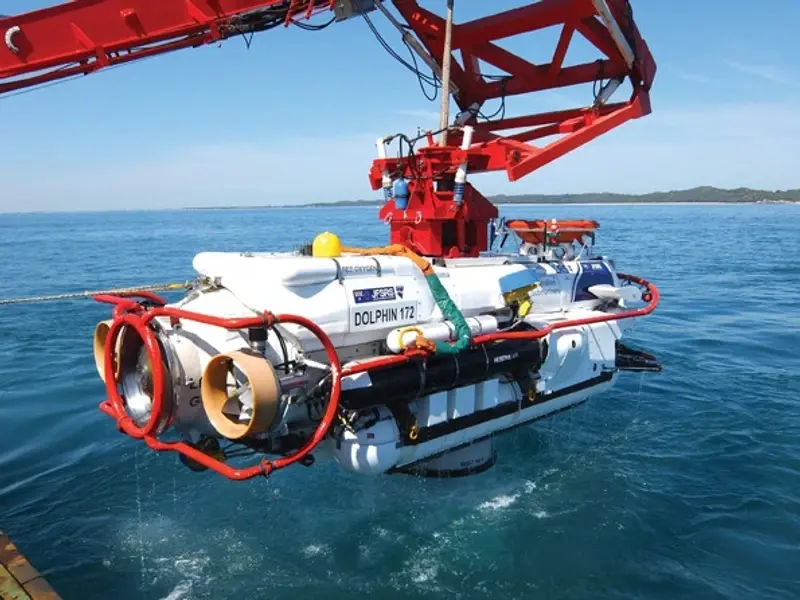

James Fisher provides a range of marine services, such as ship management, ship-to-ship transfers, subsea excavation, and employing divers to go underwater and undertake surveys, installations, etc, for a range of projects.

MARINE SUPPORT 'HIT BY WEATHER'

Speaking to Shares, chief executive Eoghan O’Lionaird said the profit hit in marine support was down to one project, decommissioning a wind farm in the North Sea, which was ‘literally hit by the weather’.

He explained, ‘It turns out the client’s understanding of the work, and therefore ours, was incomplete, so extra and very difficult work was required. And because of the bad weather we only had a certain window to complete the work, and ran out of time. It’s nothing more than bad luck, and we’ll be going back in a few months to finish the job.’

A big driver of growth for James Fisher was its performance in offshore oil, with big jumps in revenue, profit and margins, which the company said reflected a steady improvement in market conditions in the inspection and maintenance market within the oil and gas sector.

OIL AND GAS STILL IMPORTANT

Oil and gas may not be a hot growth sector, particularly as the ever-sharpening focus on climate change casts fossil fuels in a bad light.

But O’Lionaird insisted oil and gas is still a ‘hugely important’ part of the energy mix for modern economies, alongside nuclear and renewable energy, and said the firm’s growth in the sector will come more from beating its competitors to contracts.

He said, ‘The market hasn’t come back to the growth rates seen in 2012-13? but we’re fully invested in offshore oil. We’re a small player compared to our competitors, but we continue to support our customers and we’ve continued to take market share.’

O’Lionaird took over the role of chief executive last October and is reviewing the business to ‘create a plan for further growth in shareholder value for the future’.

He said that ‘whilst James Fisher has a strong track record of delivering increased profits and dividends over a long period’, the dividends will also be part of the review.

The firm reported a total dividend for 2019 of 34.7p per share, up 10% from the 31.6p declared the previous year. This equates to a dividend yield of 1.92%.

O’Lionaird refused to guarantee protection to the dividend but said, ‘We recognise it is an important factor for shareholders, and we are committed to maintaining a progressive dividend model.’