Macau Property Opportunities (MPO) posts its first adjusted net asset value (NAV) growth of 0.3% in the second quarter of 2016 after nearly two years of decline.

The closed-end property investment fund climbs 8.3% to 140.7p on the news.

In 2014, Macau, the only place in China where gambling is legal, was hit by China’s anti-corruption campaign as it aimed to prevent bribery, including junkets to encourage big spenders to gamble.

However, the campaign was blamed for gaming revenue falling for the first time in 2014 and a slower economy in Macau, prompting a new strategy of attracting more non-gambling visitors.

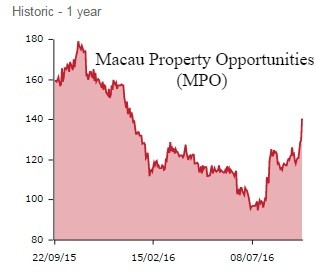

In response to the crackdown, MPO’s share price crashed from a ten-year high of 253p in July 2014 to 150.5p at the start of 2016 as earnings at Macau’s six biggest casino operators dropped by 40% in 2015.

The fund’s portfolio dropped in value for the second consecutive year to $393.7 million.

However, Macau’s largest casino operator, Sands, says June was the first month in two years in which its gaming revenue grew.

MPO chairman Chris Russell says the fund has focused on asset management and believes a recovery in property market values may be in sight as low-property transactions have recovered.

Despite opening two new casino resorts, he has warned that the VIP gaming sector remains volatile.