This morning’s half-year report from specialist insurer Sabre (SBRE) should be ringing alarm bells for investors in its mainstream car and home insurance rivals.

Sabre takes what chief executive Geoff Carter calls a ‘prudent’ approach both to risk and returns, putting underwriting discipline and profitability above volume growth.

In the first half it raised premiums to offset claims inflation which it says is running at ‘around 7% to 8% a year’, well above the 5% level reported by other insurers, in the knowledge that it might cede market share to more competitive players.

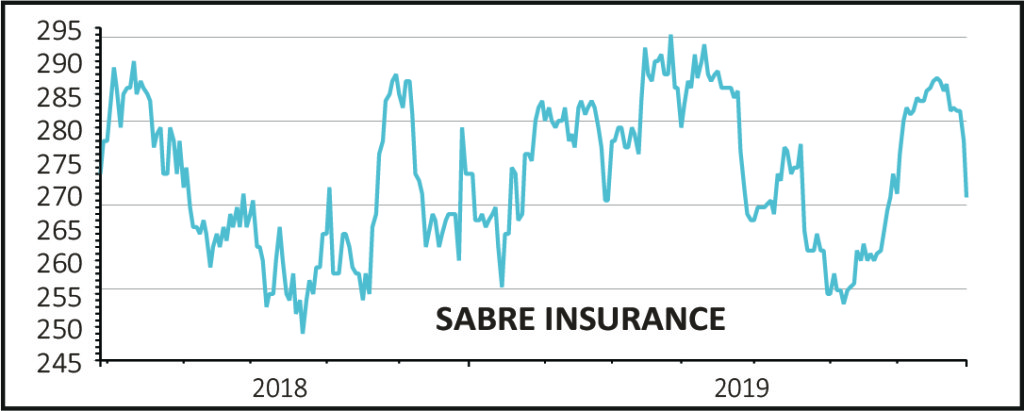

In the event, a 7% fall in gross written premiums to £101m was better than might have been expected and the fact that the combined operating ratio stayed above 70% was a good out-turn. Despite this the shares are giving up 3% to 270p.

READ MORE ABOUT SABRE HERE

Claims inflation has been a major headache for the car insurance industry for the last year or more, driven by increased numbers of vehicle thefts, the increased cost of parts and higher labour costs.

The Association of British Insurers (ABI) revealed yesterday that the car repair bill for insurers in the first quarter of 2019 was £1.2bn, the highest quarterly figure since it started collecting the data in 2013.

More sophisticated vehicle design and the proliferation of technology is driving up the cost of repairs while at the same time a weak pound has pushed up the cost of imported parts. Higher labour costs at repairers are compounding the problem.

Even more alarming, in the first three months of the year the cost of pay-outs for vehicle theft rose 22% to £108m due to an increase in thefts of high-value vehicles which often have keyless entry systems. Home Office figures show a 50% rise in vehicle thefts over the last five years.

On the touchy subject of the Ogden rate, again Sabre took a more prudent view than some of its competitors by sticking with the official -0.75% rate. As a result it was able to write back £0.3m of reserves following the change in the rate to -0.25%.

Many other firms had assumed a rate of 0%, which had been the prevailing rate in the market, and as such are likely to announce that they are increasing their claims reserves when they update the market in coming weeks.