Oil services minnow SeaEnergy (SEA:AIM) falls 11% to 4p as it warns of a substantial loss in 2015 amid a downturn in industry spending.

However it says there are signs of recovery in 2016 and a new working capital facility should at least ensure the company will be around long enough for investors to see if this can materialise. The company can draw £1 million from the facility over the next 12 months.

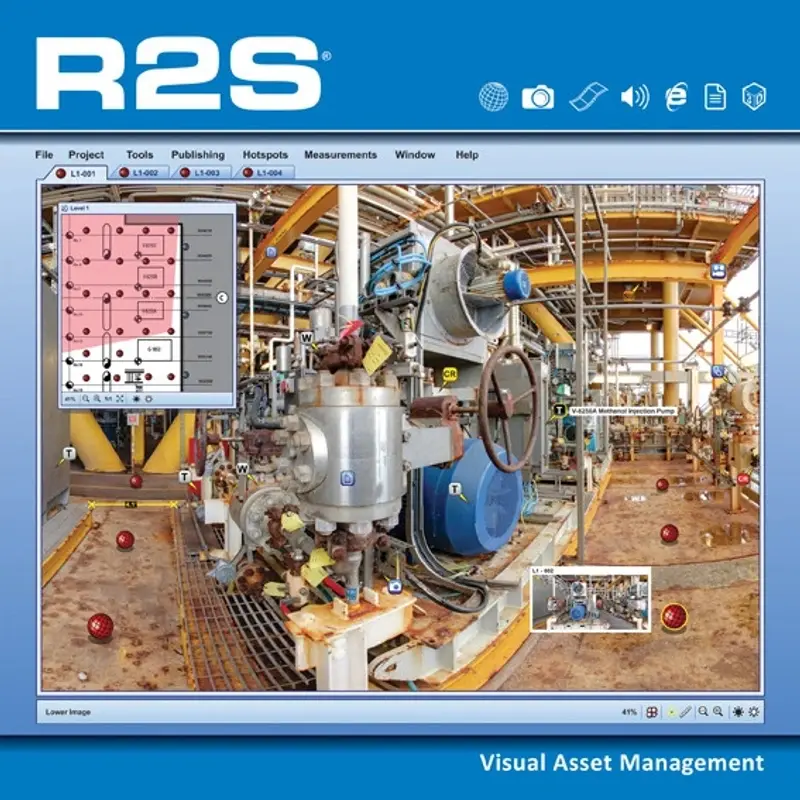

We wrote on the Aberdeen-based firm in February when it had yet to see 'any oil price related project cancellations or deferrals', more than nine months later it is a very different story but we still think the group's visual asset management (VAM) technology - delivered htrough its R2S business - has some merit.

Effectively this VAM is an enhanced version of Google's (GOOG:NDQ) Street View feature. It allows oil company employees to monitor and explore offshore infrastructure through high resolution images with individual diagnostic data tagged to certain components. From the point of view of the client base, which includes BP (BP.),Chevron (CVX:NYSE), ExxonMobil (XOM:NYSE), Royal Dutch Shell (RDSB) and Total (FP:PA), the offering should remain attractive at lower oil prices as it removes the cost and disruption of sending staff out to platforms to plan and direct maintenance. In the future it could be a useful tool in the decommissioning of assets.

Full year turnover is expected to come in at around £2.6 million - the company posted £1.8 million in the first half. SeaEnergy has nearly completed its exit from its ship management business.

The company has a pretty chequered history. Formed four decades ago it used to go under the name Ramco Energy. Once among the largest companies on AIM off the back of a big find in Azerbaijan it then ran up huge losses after a plan to restart production from an Irish gas field went disastrously wrong.