- First-quarter sales miss forecasts

- Full-year growth and margins confirmed

- Strong growth from emerging markets

Smith & Nephew (SN.) topped the FTSE gainers on Wednesday, rising 3.4% to £10.16 despite medical equipment maker missing first quarter sales estimates due to soft trading in its Advanced Wound Management franchise.

Year-to-date the shares continue to lag the FTSE 100, falling 5% compared with a 6% increase in the blue-chip index.

GUIDANCE REASSURES

Underlying first-quarter revenue was up 2.9% to $1.39 billion, slightly below consensus forecasts of $1.4 billion.

Chief executive Deepak Nath commented: ‘Revenue growth in the first quarter was driven by solid performance in our Orthopaedics and Sports Medicine & ENT businesses, partially offset by some anticipated softness in Advanced Wound Management.’

Investors chose to focus on the ‘confident’ outlook and expectation that all three business units will deliver another year of ‘strong’ revenue growth. Management confirmed its expectations for revenue growth in the 5% to 6% range and a trading profit margin of at least 18%.

HOW DID THE BUSINESS PERFORM?

Reported revenue grew 2.2%, reflecting a 0.7% headwind from foreign exchange movements. Additionally, tough US comparatives in 2023 when the surgical businesses made a strong start to the year equated to roughly a 1.5% headwind.

Outside of weakness in Wound Management, Orthopaedics and Sports Medicine & ENT saw mid-single digit percentage revenue growth to $567 million and 441 million respectively.

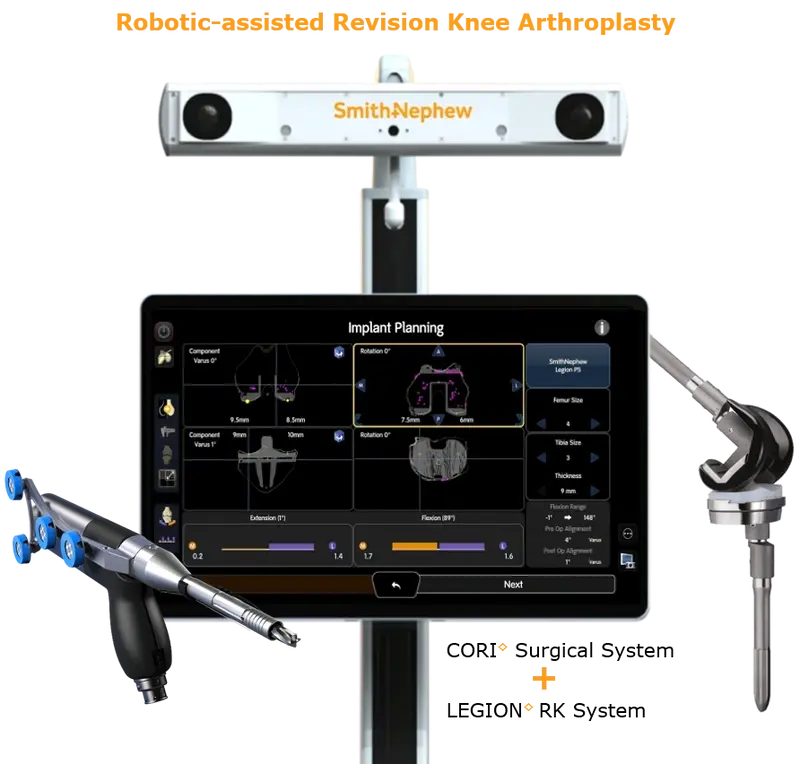

Within Orthopaedics, other reconstruction revenue grew 18% as the company continues to benefit from its unique CORI surgical robotics-assisted system.

The platform is the only one on the market which allows for personal planning using simulation and AI. Based on individual clinical profiles, the software provides procedural planning and implant placement guidance.

The company conceded there remains a ‘significant opportunity’ to improve US performance in hips and knees with new leadership driving a ‘sharper’ focus.

Geographically, established markets grew 1.3% despite a 0.6% fall in the US while emerging markets delivered strong 11.6% growth led by double-digit growth in Orthopaedics.