Investors in equipment-rental firm VP (VP.) breathe a sigh of relief after the firm delivers a positive set of full year results and an upbeat outlook for this year.

Revenues for the year to 31 March are up 26% to £383m thanks to the consolidation of the Brandon Hire business while pre-tax profits are up 9% to £33.6m. Shares rally 8% to 800p on the news.

READ MORE ABOUT VP HERE

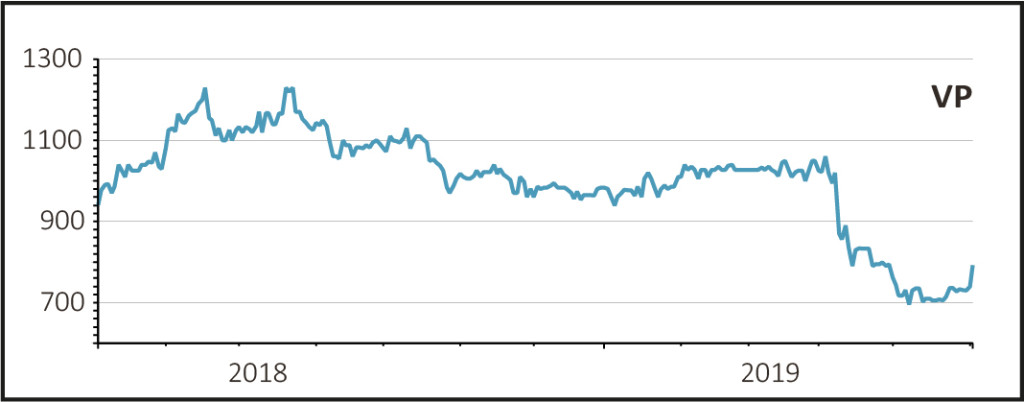

Shares in VP have been under a cloud, falling 25% since the Competition & Markets Authority (CMA) announced in early April that it was investigating possible price fixing in the market for rented groundwork products.

That news prompted us to cut the stock from our Great Ideas list at 916p for a loss of 8.4% pending the outcome of the regulatory probe.

The company says that it will respond to the CMA shortly. Meanwhile it has set aside £4.5m of cash - classified as an exceptional cost in the results - in line with the CMA’s guidance and based on previous cases, although it denies any culpability.

In terms of operations, the UK business - which makes up 90% of group revenues - grew turnover by 29% helped by the Brandon Hire acquisition and ‘solid demand’ from the infrastructure sector for groundworks, low-level access and trackside works.

Many of these businesses are starting to win contracts in mainland Europe as well as the UK, especially the Groundforce and TPA units.

Meanwhile the International division, which is made up of oil and gas services firm Airpac Bukom and testing business TR, saw a slight recovery in revenues as sales to the onshore alternative-energy industry start to grow.

VP made one small acquisition in the post-close period, the £3.3m purchase of Sandhurst - which rents excavator attachments to the construction and civil engineering sector - leaving it with plenty of cash.

In a sign of confidence the final dividend has been raised to bring the total pay-out for the year to 30.2p, an increase of 16%.

Analysts at N+1 Singer describe the shares as ‘extremely attractive’ at current prices and note that even if the CMA fines the company double what it has set aside, that amount is ‘dwarfed by the £100m reduction in VP’s market value since the investigation was announced’.

While the core business is ticking along and management have been very canny acquiring and integrating the Brandon Hire business - a deal described by research firm Equity Development as ‘a masterstroke’ - the shares are unlikely to revisit their previous levels until the outcome of the CMA investigation is known.