27 October 2022

Power Metal Resources PLC

("Power Metal" or the "Company")

Golden Metal Resources - Golconda Gold Anomalies

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update from Golden Metal Resources PLC ("Golden Metal" or "GMT"), the Company's 83.13% owned subsidiary, which is planning to list on the London capital markets this quarter.

The most recent update from Golden Metal was released on 26 August 2022 and can be found at the link below:

HIGHLIGHTS:

- Recently obtained historical dataset from a high-resolution geochemical soil survey covering the entirety of the Golconda Summit Project ("Golconda Summit" or the "Project"), has highlighted three zones of strongly anomalous arsenic and gold mineralisation for further investigation.

- Rock sample assay results from a geological mapping and sampling programme over Golconda Summit, undertaken by Golden Metal's in-country senior geological consultant, have confirmed strong arsenic (pathfinder for Carlin-type gold mineralisation) and gold anomalism.

- At the Garfield Project assay results are pending for the recently completed soil geochemical survey.

- At the Pilot Mountain Project three-dimensional ("3D") modelling of the high-resolution induced polarisation ("IP") geophysics survey data collected over Golden Metal's flagship project has been commissioned, with results eagerly awaited.

Oliver Friesen, Chief Executive Officer of Golden Metal Resources PLC, commented:

"Our 100% owned flagship Pilot Mountain Project has been a source of particular focus for GMT and our investors, with good reason, as we continue to engage in various discussions regarding possible technical and financial engagement at a project level.

Work has continued in parallel across GMT'S other Nevada interests and today's update is focused on significant gold anomalism confirmed across the Golconda Summit Project where we are targeting a Carlin-type gold discovery.

Review of newly acquired historical datasets, together with recently completed detailed geological mapping and rock sampling at Golconda Summit have delivered clear evidence of gold and arsenic anomalism. These results, in GMT's technical view, further underpin the strong value proposition associated with bringing this compelling gold opportunity to UK investors alongside the rest of our exciting Nevada focused project portfolio.

We are seeing a steady improvement of market conditions, and particularly those surrounding junior mining and exploration companies. As a result, we are seeking to secure the UK listing of Golden Metal Resources as soon as possible.

Paul Johnson, Chief Executive Officer of Power Metal Resources PLC, commented:

"The news from Golconda Summit today is the first key set of exploration results, and they have ratified our belief in the potential of the Project to host a Carlin-type gold deposit. As a result, Golconda has been designated as a priority Project for follow-on exploration and subsequent drilling.

The combination of the strategically significant Pilot Mountain Project combined with the blue-sky exploration upside offered by Golconda Summit, as confirmed today, makes Golden Metal, in our view, a unique investment proposition focused on Nevada, USA and we look forward to the planned listing in London."

Further Information: Golconda Summit

Within Carlin-type gold deposits, which are found almost exclusively within northern Nevada, there are multiple alteration minerals that are typically found proximal and near to Carlin-type gold deposits. The most notable of these is arsenic, so as a result arsenic anomalism is often one of the best proxies when looking for Carlin-type gold deposits. Additionally, arsenic is considered to be highly mobile (compared to gold) and therefore arsenic can more easily be remobilised along fluid conduits away from Carlin-type mineralised systems.

Geochemical Sampling

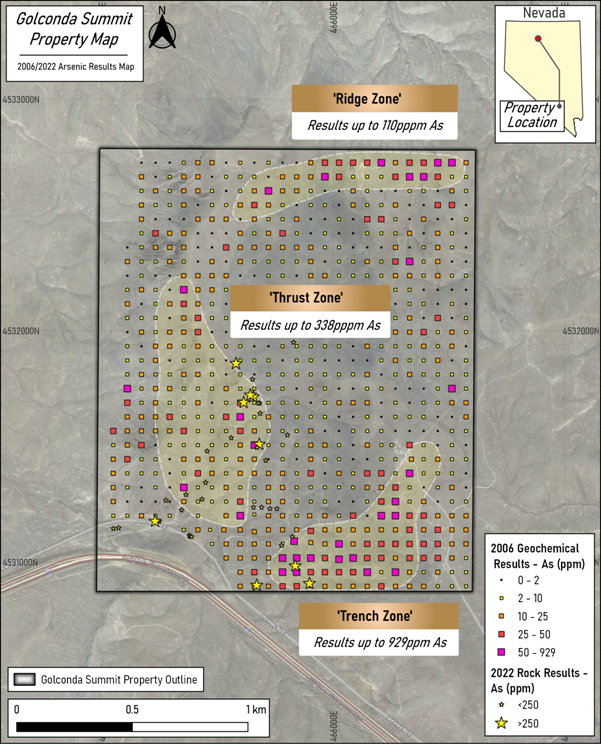

Golden Metal have obtained the dataset for a high-resolution (60m x 60m sample spacing) soil geochemical survey completed across the entire Golconda Summit Project in 2006. This historical geochemical dataset includes 741 multi-element assay results from which three discrete anomalous zones have been identified: 'Trench', 'Thrust', and 'Ridge' zones. These zones are defined by the arsenic and gold results, of which there is a strong correlation noted. The 'Trench' zone is coincident with historical trenching completed within the Project, while little historical work is known to have been completed within the 'Thrust' and 'Ridge' zones (see Figure 1).

'Trench Zone' - Strong arsenic and gold anomalism was identified with individual results up to 929ppm As and 1846ppb Au (1.846g/t; Sample GS-358).

'Thrust Zone' - Strong arsenic and gold anomalism was identified with results up to 338ppm As and 402ppb Au (Sample GS-134).

'Ridge Zone' - Strong arsenic and gold anomalism was identified with results up to 110ppm As and 782ppm Au (Sample GS-679).

Rock Sampling/Mapping

Detailed mapping and rock sampling was recently completed across Golconda Summit by Golden Metals' in-country senior geological consultant. A total of 41 individual rock samples were taken, and detailed mapping of the easterly dipping iron-point thrust fault was completed. Most of the sampling was done within or near to the 'Thrust Zone'. Strong arsenic and gold anomalism was identified within multiple samples, and in particular within five samples that are within the mapped iron-point thrust fault.

As with the geochemical results, a strong correlation between arsenic and gold results was noted. Of the 41 samples collected, 9 samples returned >250ppm As, with 6 samples returning >500ppm As (500ppb represents upper limits of analysis technique used). The three top gold results from the rock sampling completed were all from samples that returned >250ppm As (838, 335, and 280ppb Au).

Geological Model

At Golconda Summit, GMT's geological consultant has completed several weeks of detailed mapping and has identified the presence of the Iron Point thrust fault. This thrust fault has controlled the emplacement of non-reactive 'upper plate' rocks, over top of reactive 'lower plate' rocks. Encouragingly (see Figure 2), a very strong arsenic anomalism within rock and soil sample results is coincident with the surface expression of the Iron Point thrust fault. The postulation is that there has been remobilisation of Carlin-type fluids up along the Iron Point thrust fault - with the view that one would need to drill test east of this thrust fault. Interestingly, the 'Trench Zone' is located with this drill target zone, and here, historical trenching completed by Nerco Mining Company in 1989 returned up to 7.6m of 19.7g/t Au within non-reactive 'upper plate' rocks. Secondary sub-vertical faults have been mapped across this trench area which could have controlled the remobilisation of Carlin-type gold from reactive 'lower-plate' rocks below.

Trenching as well as follow-up reverse circulation ("RC") drilling is planned post the planned listing of Golden Metal. Golden Metal will be the first company to ever drill test at Golconda multiple prospective 'lower plate' units including the Antler Peak limestone, Edna Mountain and Preble Formations, all of which host Carlin-type gold deposits elsewhere in Northern Nevada.

Figure 1 - Golconda Summit: A plan map of the Project area including the recently obtained 2006 geochemical results as well as 2022 rock sampling results. Arsenic is a strong pathfinder for gold within Carlin-type gold deposits.

Figure 2 - Golconda Summit: A plan map of the Project showing the location of the 'Ridge', 'Thrust' and 'Trench' zones in relation to the major iron-point thrust fault which has been mapped across the Project.

The diagrams and images presented above may be viewed on GMT's website and may be reached through the following link:

https://www.goldenmetalresources.com/project/the-golconda-summit-project/

Further photographs and videos from the drill programme are and will be available on the Company's website gallery section, through the following link:

https://www.goldenmetalresources.com/investors/gallery/golconda-summit-project/

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O'Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules - Note for Mining and Oil & Gas Companies. Mr O'Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

| Power Metal Resources plc | |

| Paul Johnson (Chief Executive Officer) | +44 (0) 7766 465 617 |

| | |

| SP Angel Corporate Finance (Nomad and Joint Broker) | |

| Ewan Leggat/Charlie Bouverat | +44 (0) 20 3470 0470 |

| | |

| SI Capital Limited (Joint Broker) | |

| Nick Emerson | +44 (0) 1483 413 500 |

| | |

| First Equity Limited (Joint Broker) | |

| David Cockbill/Jason Robertson | +44 (0) 20 7330 1883 |

| |

NOTES TO EDITORS

Power Metal Resources plc - Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company's growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.

Exploration Work Overview

Power Metal has multiple internal exploration programmes completed or underway, with results awaited. The status for each of the Company's priority exploration projects is outlined in the table below.

| Project | Location | Current POW % | Work Completed or Underway | Results Awaited |

| | | | | |

| Athabasca Uranium | Canada | 100% | Ground exploration programme complete at 3 properties. Preliminary planning for work in Spring/Summer 2023 is ongoing. | Assay results from samples collected during fieldwork. |

| Molopo Farms | Botswana | c.53%# | T1-6 conductor target drilling underway. Further MLEM surveys planned over additional AEM targets identified. | Drill programme updates and findings from further MLEM survey work. |

| Tati Project | Botswana | 100% | RC drilling and sampling of mine dumps complete. | Review of mine dumps sampling and assay results from RC drill programme. |

# subject to completion of acquisition announced 18.5.22 interest will increase to 87.71%

Exploration work programmes may also be underway within Power Metal investee companies and planned IPO vehicles where Power Metal has a material interest, the findings from which will be released on their respective websites, with simultaneous updates through Power Metal regulatory announcements where required. These interests are summarised in the table below:

| Company | Status/Operations | Link |

| First Class Metals PLC | Investment - POW 27.91% Exploration in the Schreiber-Hemlo region of Ontario, Canada |

|

| First Development Resources PLC | Planned IPO - POW 62.12% Exploration in Western Australia and the Northern Territory of Australia | www.firstdevelopmentresources.com

|

| Golden Metal Resources PLC | Planned IPO - POW 83.13% Exploration and development in Nevada, USA |

|

| Kavango Resources PLC | Investment - POW 14.03% (subject to completion of Kanye Resources disposal announced 8.7.22 and issue of Kavango shares e.g. financing announced 24.10.22) Exploration in Botswana |

|

| New Ballarat Gold PLC | Planned IPO - POW 49.9% Exploration in the Victoria Goldfields of Australia | A new website is currently in development which will be found at www.newballaratgoldcorp.com. In the interim further information in respect of NBGC can be found at: https://www.powermetalresources.com/project/victoria-goldfields/.

|

| Uranium Energy Exploration PLC | Planned IPO - POW on listing estimated 40-55% Uranium exploration in the Athabasca region of Canada |

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.