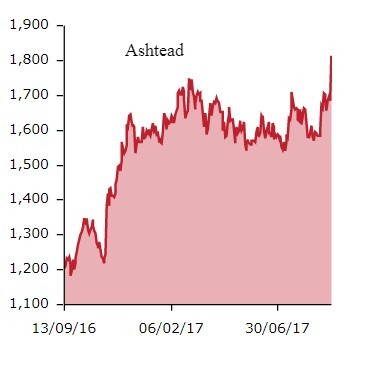

Equipment rental specialist Ashtead (AHT) is up 5.4% to £17.75 after releasing a strong set of first quarter to 31 July results. It also indicates that it could make hay from cleaning up the devastation left by Hurricanes Harvey and Irma.

Ashtead rents equipment that lifts, powers, generates or moves to the US and UK construction market.

The company is heavily skewed towards its US entity Sunbelt, which generated 92% of 2017’s profits and puts it in a good position for any mass clean-up operation needed.

Ashtead’s group rental revenue is up 17% to £828.8m with pre-tax profits up 20% to £238.5m both on a year on year basis. Its earnings per share figure also enjoys a 21% lift to 31.5p compared to 24.2p in the first quarter of 2016.

The company’s chief executive Geoff Drabble says the hurricane season is ‘generating significant activity’ and ‘it will result in an increase in demand for our fleet’. However Dabble adds that it is too early to quantify its impact accurately on the business.

Where’s the growth coming from?

Ashtead’s US division Sunbelt has delivered 16% rental growth in the first quarter, an improvement on the 10% growth in enjoyed in the fourth quarter of 2017.

Investment bank BNP Paribas says the company’s results were slightly ahead of its expectations. Jefferies notes that Sunbelt sustained mid-teens rental revenue in August and September this year ‘prior to any Hurricane Harvey and Irma boost’.

The US equipment hire market is highly fragmented although Sunbelt is the second largest company in the market behind United Rentals. Barclays notes that Sunbelt is strong in Texas and Florida where it enjoys a market share above its US average of 7%. As these were the hardest hit regions by Hurricanes Harvey and Irma it bodes well for the company going forward when the construction begins.

Ashtead is trading on 15.1 times 2018’s 117.2p per share of earnings based on Barclay’s forecasts which seems good value if Reuters peer group average of 19.2 times is considered.

Sticking with Barclays forecasts, Ashtead is paying a dividend yield of 1.8%. Given its strengths in the affected parts of the US, the company may improve further once the rebuilding starts. One issue might be the weakening dollar as it makes most of its cash in the US.