Covid-19 vaccine maker AstraZeneca (AZN) reported a 10% increase in core revenue and saw profit more than double as new treatments powered performance last year. The pharma giant also updated on developments of its Covid-19 vaccine after recent criticisms.

AstraZeneca’s Covid-19 vaccine first came under pressure after the German authorities recommended that it should be limited to people under 65 year of age. South African authorities then halted its own roll-out after raising concerns over its effectiveness.

AstraZeneca admitted that the vaccine had limited effectiveness against the new South African strain, but that it remains affective against the Kent strain. Despite these setbacks the vaccine remains one of the most important vaccines in the fight against the pandemic.

SURGING PROFITS

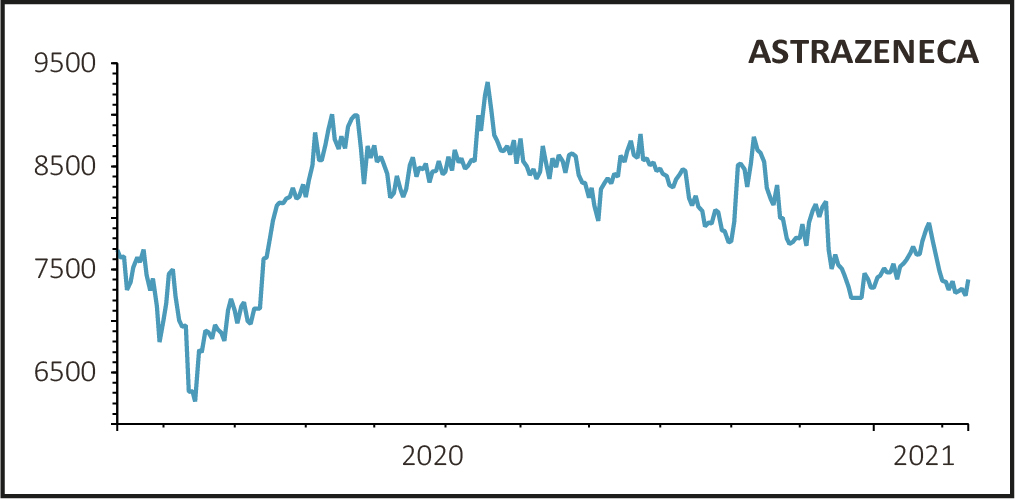

Revenue at constant currencies hit $26.61 billion in the year to 31 December 2020, with pre-tax profit jumping from $1.55 billion to $3.92 billion thanks to new oncology and biopharmaceuticals medicines. Earnings 18% higher at $4.02 per share, meeting analysts’ expectations and sending the stock 1.8% higher to £73.75.

The contribution from new medicines jumped to from 43% to 52% of total product sales on the back of 33% growth, to $13.95 billion. This was largely driven by sales into emerging markets, which grew 59% in constant currencies.

The cancer franchise, which represents 43% of sales, was the main contributor to growth rising 24% in constant currencies to $11.45 billion. Respiratory and immunology sales were stable at $5.37 billion reflecting the impact of Covid-19 in China.

The key drugs in the cancer division all performed strongly with lung cancer drug Tagrisso sales up 36%, Lynparza (multiple cancers) up 49% and Imfinzi (lung cancer) up 39%.

MARGINS, CASH AND GUIDANCE

The reported operating margin increased by eight percentage points to 19% and the core profit margin was 1% higher at 28% reflecting an underlying improvement in business performance and declines in working capital.

Net operating cash flow surged 61% to $4.8 billion while EBITDA (earnings before interest, taxes, depreciation, and amortisation) grew 27% to $8.3 billion. The company finished the period with net debt of $12.1 billion, up $206 million.

AstraZeneca guided for total revenue increases in low-teen percentages with faster growth in core earnings per share (EPS) to $4.75 to $5. This excludes the Covid-19 vaccine, which the company will report separately from next quarter.

Currently analysts have penciled in 15% growth in 2021 revenues to $30.63 billion and core EPS of $5.1 according to data provided by Refinitv.