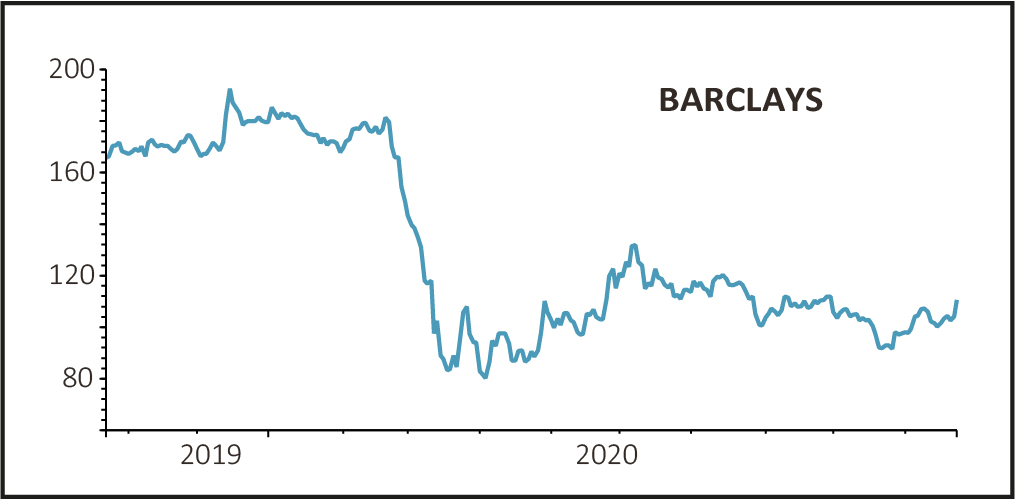

Shares in high-street lender Barclays (BARC) topped the FTSE 100 on Friday, rallying 6.8% to 111p despite a lacklustre third quarter trading update as chief executive James ‘Jes’ Staley held out hope that the bank might resume dividend payments after talks with regulators.

For the third quarter, Barclays posted a pre-tax profit of £1.1 billion compared with £200 million a year ago. However, last year’s third quarter included litigation and conduct charges - mostly for mis-sold Payment Protection Insurance (PPI) - of £1.57 billion, so on a ‘clean’ basis earnings were significantly lower than a year ago.

RECORD BAD DEBT PROVISIONS

This was partly due to increased operating costs, which rose 3% to £3.4 billion during quarter, and partly to another increase in impairment or bad loan charges, which increased over 30% from last year to £600 million.

Total provisions now stand at over £9 billion, their highest level ever, and they may need to rise further in the fourth quarter although the bank insisted provisions for the second half would be lower than the first half.

Despite the increase in charges, the bank’s Core Equity Tier 1 capital ratio hit a record high of 14.6% thanks to a fall in risk-weighted assets and the cancellation of the 2019 full-year and 2020 interim dividends.

Staley hinted that, subject to discussions with the Prudential Regulatory Authority (PRA), the bank would look to resume dividend payments as it ‘recognises the importance of capital returns to shareholders’. An update is likely in January when the bank posts its full year earnings.

Discussing the potential for negative interest rates in the UK, the chief executive said Barclays was 'prepared to run with negative rates', although he was 'reluctant' to pass the impact on to retail customers in the form of higher charges.

However, he pointed out that UK customers have benefited from over £100 million of waived overdraft fees and charges since the start of the pandemic and that his job was ultimately to 'maintain Barclays' financial integrity', leaving the door open for the bank to introduce account charges.