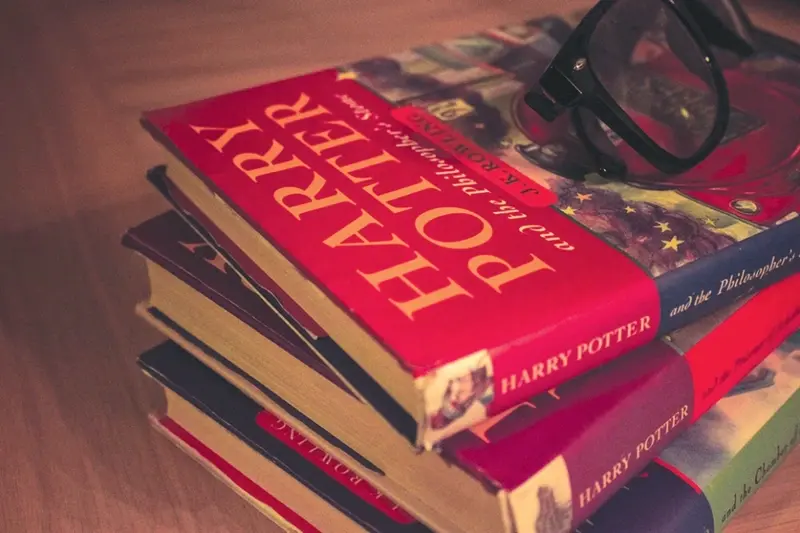

Small cap Bloomsbury Publishing (BMY) plans to move away from the magical world of Harry Potter and fiction books to focus on non-consumer publishing for the business to business (B2B) academic and professional information market.

Sales of Harry Potter, including the illustrated edition of the first book, grew by 133% in the year to 29 February 2016. Revenue shot up 57% to £41.8 million. However the market didn’t seem too impressed by the strategic shift in business focus with the shares down 3% to 150.68p.

The Academic & Professional division made £32.7 million revenue in the 12 month period. In comparison, the Children’s & Educational division generates sales of £41.8 million; and the Adult publishing arm had £46 million revenue.

The growth plan for a new division called Bloomsbury Digital Resources Publishing, under the Bloomsbury 2020 initiative, might be lucrative due to academic libraries’ collective estimated $5 billion budget.

The company is targeting revenue of up to £15 million and profits of £5m from Bloomsbury Digital Resource Publishing by 2021/22, which is a modest and long-term outlook for profitability.

Bloomsbury’s decision to go digital is also a smart move as digital revenue has increased over the last year, and is currently offsetting weaknesses in print revenue.

A wider range of digital products includes updating content from extensive backlists, licensing high-quality third party intellectual property and resource material from content providers.

In addition, Bloomsbury will reorganise its business by separating it into consumer and non-consumer divisions.

'Bloomsbury aims to become the go-to scholarly partner for copyright holders looking to reach higher educations institutions around the world, but who lack the expertise and infrastructure to do so effectively,' proclaims the London-based business.

Investec forecasts a decline in pre-tax profit in both 2017 and 2018 to reflect investment into restructuring the business. It has a 186p price target for the next 12 months and says successful execution/evidence of delivering on the growth plans should drive a re-rating in the share price.