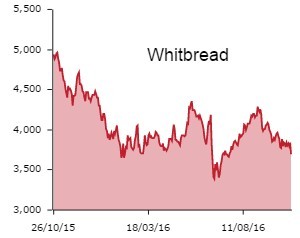

Investors sense there is potential trouble brewing at Costa Coffee operator Whitbread (WTB) as interims reveal a 1.8% drop in operating margins due to investments and a one-off implementation cost. That plunged the shares to the head of the FTSE 100 loser board, the stock slumping 3.6% to £37.04.

Whitbread says it expected first half margins to be lower due to investments in refurbishments, IT infrastructure, digital capabilities and early introduction of the National Living Wage.

Underlying operating profit at Costa has fallen by 4% to £64.6m in the six months to September, while profit at Premier Inn and its restaurants is up 8.9% to £271.5m.

Neil Wilson from financial firm ETX Capital praises Whitbread’s ‘good figures’ but is cautious over lower sales growth of 3% at Costa in the year to March compared to 6.5% in the prior year. He also notes that Costa has to deal with rising prices as coffee prices have reached their highest level in two years, which will intensify due to the weaker pound.

One of the most obvious ways to defend margins is to increase prices, which could backfire with customers. Costa has already increased prices in January, which helped to drive like-for-like sales 2.6% higher in the 13 weeks to 2 June.

Premier Inn’s like-for-like revpar, the average revenue from the number of occupied rooms, has increased by 1.1%, although extensions have diluted underlying revpar by approximately 1.7%.

Despite having 9.3% new rooms available, Premier Inn’s total revenue declined by 0.5% with occupancy of 82.6% in the first half of the year, which indicates falling occupancy or lower rates.

Analyst Stuart Gordon from private bank Berenberg is upbeat, noting strong growth from the Costa Express business, which he feels is underappreciated. Gordon believes the Brexit vote will continue to restrict the recovery in Whitbread’s share price until the final outcome is better understood.