Struggling Swiss miner Glencore (GLEN) jumped 5.3% to 233p following signs the company is getting back on track.

The FTSE 100 mining giant had a tough time in 2019 with early mine closures, rising costs and taxes, and investigations launched into the firm by the US Department of Justice and the UK’s Serious Fraud Office.

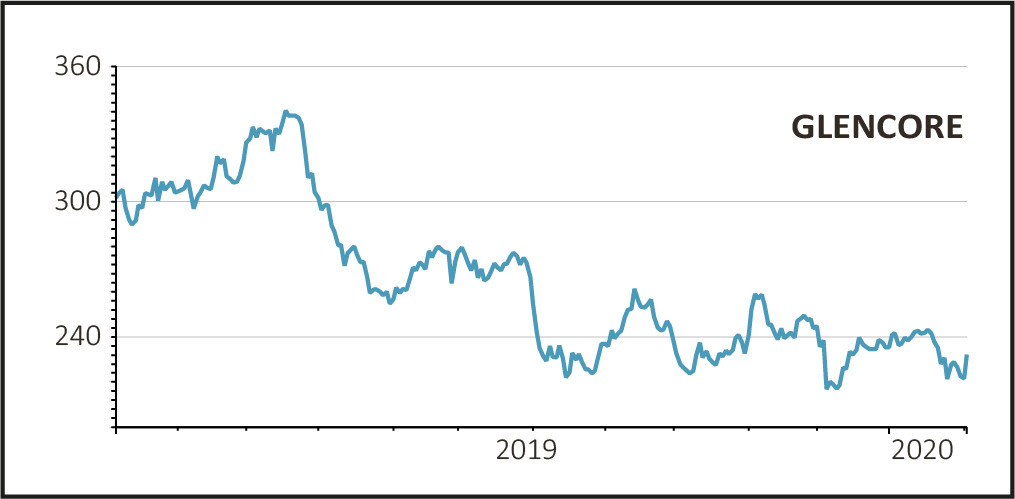

The share price fell correspondingly from a high of 340p to end the year around the 230p mark.

In full year production numbers for 2019 released today, the miner’s overall copper output was down 6% to 1.37m tonnes, while it also reported falling production of gold, silver, nickel and ferrochrome.

The company’s production had been affected throughout the year by outages, stoppages and various technical problems at many of its mines, particularly in Africa.

But the numbers also show signs the firm is getting back on track, operationally at least, with fourth quarter output at its Katanga mine - a key asset for the firm which produces copper and cobalt - rising 11% to 65,400 tonnes in the three months to 31 December.

That helped offset the early closure of its Mutanda mine and helped increase overall cobalt production by 10% to 46,300 tonnes, with analysts taking the view the company is starting to overcome operational difficulties, a view strengthened by the fact Glencore has kept its production guidance for 2020 unchanged.

Glencore temporarily closed Mutanda in November in response to falling cobalt prices.

The company has invested heavily in mining cobalt with chief executive Ivan Glasenberg reportedly convinced current global production of the metal - often described as ‘blue gold’ - will need to triple by 2030 to meet demand as sales of electric vehicles (EV) soar. Cobalt is a key component in EV batteries.

However, the move hasn’t paid off in the short-term with the cobalt market falling around 40% in 2019. Miners rushed a few years ago to produce cobalt as the price skyrocketed ahead of anticipated demand for EVs. But demand at the time failed to take off as expected, with the resulting cobalt surplus sending prices down.

Following the production numbers, RBC Capital Markets analyst Tyler Broda said Glencore ‘continues to screen as a strong value proposition’, and highlighted the strong quarter at Katanga as a sign of encouragement.

According to Stockopedia, Glencore has a forward PE ratio of 12.4.