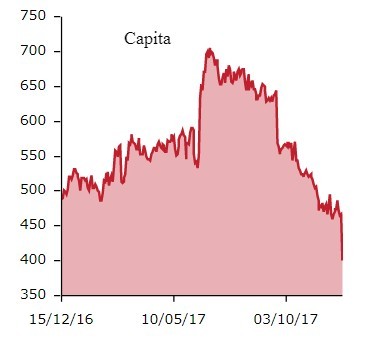

UK outsourcer Capita (CPI) is down a hefty 14.3% to 399.3p after announcing its bid pipeline is now £2.5bn.

In September the firm said it would be £3.1bn and although some of these losses are due to different accounting rules, the market is clearly not impressed.

Analyst Stifel describes the fall in the bid pipeline as a ‘clear illustrations of the group’s woes’. The company does confirm its outlook for 2017 with underlying pre-tax profits rising ‘modestly’ for the second half of the year. But there are plenty of alarm bells in Thursday’s statement.

Capita is warning of higher than anticipated contract and volume attrition in the private sector partnership division which could impact the business in 2018.

The company is also weighed down by a load of exceptionals, including restructuring charges and impairments. These could put a big dent into 2018’s profitability and leverage is also expected to be higher than previously indicated.

SOME RAYS OF SUNSHINE

Despite Capita saying public sector contracts have ‘remained subdued throughout 2017’ it has won some notable business. Since the end of June it has won a new seven-year contract to administer the Royal Mail Statutory Pension Scheme and also extended its customer management contract with British Gas to April 2019.

The company now has a chief executive in the form of Jon Lewis. Lewis replaces the ousted Andy Parker who left after a large fall in profits was reported in March. Lewis will hope to bolster the company’s turnaround plan.

Using Stifel’s forecasts, Capita is trading on 8.6-times 2017’s 46.7p of earnings while also paying a 7.9% dividend yield.

However, Tom Sykes, analyst at investment bank Deutsche Bank, says due to investment needed to restructure the business ‘this will inevitably require cash and will put pressure on the dividend payout’.