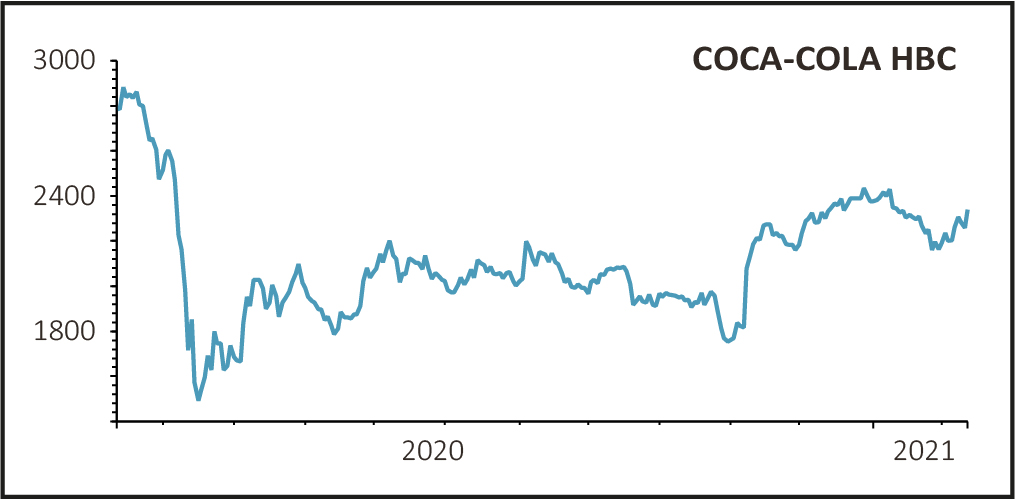

Soft drinks giant Coca-Cola HBC (CCH) was the biggest riser on the FTSE 100 on Thursday (11 Feb), the shares bid up 5% to £23.72 as the resilient Coke brands bottler reported improved second half volume trends and guided to a ‘strong FX-neutral revenue recovery’ in 2021.

In a show of confidence, the cash generative company also raised its full year dividend by 3.2% to €0.64 despite seeing an annual profit decline due to Covid-19 disruptions across its markets.

DEMONSTRATING RESILIENCE

As Shares outlined here in December, Coca-Cola HBC is a consumer packaged-goods powerhouse and strategic bottling partner of The Coca-Cola Company (KO:NYSE), giving it access to the world’s most recognisable soft drink, Coca-Cola, and an array of other brands besides.

Competitive advantages include leading market shares and a geographically diversified distribution footprint.

Pre-tax profit fell from €661.2 million to €593.9 million in 2020 on a 13.4% sales decline to €1.17 billion.

However, fourth quarter like-for-like volume was down just 0.7%, a resilient performance in the face of renewed lockdown restrictions across Coca-Cola HBC’s markets, while the full year like-for-like volume decline was contained at 4.6% thanks to a better volume performance in the second half, as the company benefited from continued growth in the at-home channel.

Four of Coca-Cola HBC’s largest markets actually grew volumes last year, namely Nigeria, Russia, Poland and Ukraine.

Improved second half trading was ‘driven by a return to growth in the at-home and greater resilience in the out-of-home, despite a resurgence of infections in many of our markets towards the end of the year’, explained chief executive Zoran Bogdanovic.

RECOVERY IN SIGHT

Coca-Cola HBC believes it can return to the growth targets set out in 2019, which was for FX-neutral revenue growth of 5% to 6%, with 20-40 basis points of EBIT margin expansion per year on average.

Yesterday in the US, The Coca-Cola Company served up forecast-beating fourth quarter earnings and said it should return to organic revenue growth this year after a very difficult 2020.