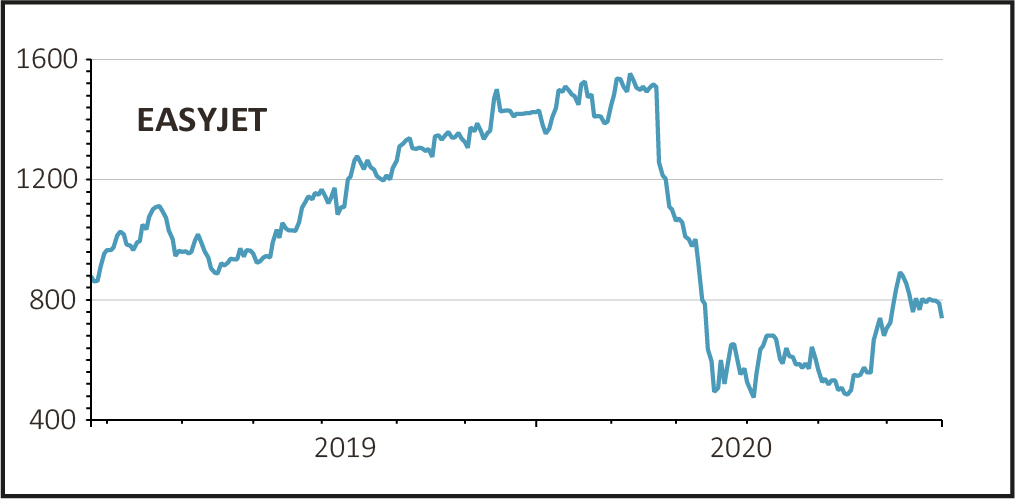

Shares in low cost airline EasyJet (EZJ) fell 5.7% to 698p after it raised £419 million through a placing to help it weather the coronavirus storm.

The airline placed 59.5 million ordinary shares in total, 15% of its existing share capital, at a price of 703p per share - a 5% discount to yesterday’s closing price of 740p.

EasyJet said the placing would ‘further enhance’ its liquidity position and credit metrics - the company is focused on maintaining its investment grade credit rating - and strengthen its balance sheet with the firm now having a cash balance of around £3 billion.

This means it now has enough cash to withstand nine months’ of full grounding of its fleet, with its scenario planning assuming a three month grounding would generate a cash burn of £1 billion, six months £2.1 billion and nine months £3 billion.

EQUITY RAISE ‘QUITE THE ACHIEVEMENT’

AJ Bell investment director Russ Mould said EasyJet’s ability to raise £419 million at a 5% discount to last night’s closing price was ‘quite an achievement’, as ‘one might have expected a greater discount’ given the ‘large risks’ present in the airline sector.

He added that the equity raise puts the airline in a ‘stronger position’, but that should there be another wave of coronavirus cases it could see its funding position ‘deteriorate rapidly’ with its £1 billion cash burn for every three months of grounding.

EasyJet resumed its flying programme on 15 June after 11 weeks of full grounding, somewhat ahead of its base case scenario of a three month grounding with cash burn therefore slightly better than forecast, which the airline said was principally driven by the proportion of customers choosing to rebook or take a voucher, rather than requesting a cash refund.

The firm added that it expects to increase capacity over the summer months as demand increases and government restrictions across Europe are relaxed.

EAYSJET NARROWS HALF-YEAR LOSSES

The placing comes as EasyJet also published its half year results for the six months to 31 March, which showed an improvement on the same period the previous year as it made a headline pre-tax loss of £193m, compared to £275m last year. Airlines typically report losses during the quieter winter months.

The results also showed the airline making progress in some key areas before the coronavirus pandemic started.

Ancillary revenue, an important area of growth for airlines, increased 5.5% to £549 million - mainly driven by checked bags and allocated seating - and now makes up 23% of its total revenue.

Its passenger load factor, a measure of how full the planes are, increased by 0.2% to 90.3%. For a budget airline, anything over 90% is considered good.

However, its total headline cost per seat excluding fuel increased 9.5% to £47.80, which the company put down to coronavirus-related disruption, but also rising maintenance, ownership and crew costs, as well as inflationary pressure from airports.

SUMMER TEST

Going forward, the big test for EasyJet over the crucial summer trading period is whether pent-up demand for sun, sea and ice cream - as pictures of packed crowds on UK beaches suggest - extends to travelling by plane to destinations overseas.

But Mould is not convinced the demand will be there this summer given the uncertainties still present.

He said, ‘Anecdotally there seems to be more of an appetite among people to drive to Europe via the Channel Tunnel, enjoying the safety of their own car, rather than sitting among strangers in a metal tube in the sky.

‘Others will have simply written off the idea of going away on a summer holiday this year and have shifted their booking to next summer.

‘With coronavirus still omnipresent around the world, it is going to be a very hard slog for EasyJet to start repairing its earnings as customer demand and the length of time that travel restrictions between various countries will stay in place remain so uncertain.’