Shares in information services and credit checking firm Experian (EXPN) were the biggest gainers in the FTSE on Tuesday, climbing 4.2% to a new all-time high of £29.15 after the company raised its growth outlook.

For the second quarter ending 30 September the firm now expects organic revenues to grow by between 3% and 5% compared with its previous forecast of flat to down 5%.

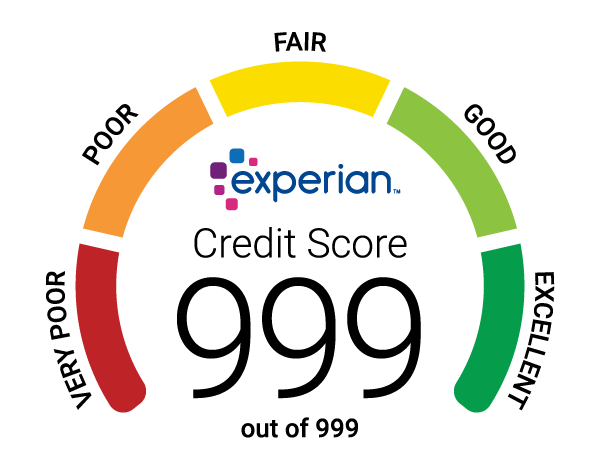

The upgrade is based on stronger than expected demand for credit checks by US mortgage lenders, which will contribute 3% to growth this quarter, as well as continued demand for consumer services like credit scoring and protection from fraud and identity theft.

Costs are also seen rising this quarter, by between 2% and 3% on an organic basis, as the firm loosens the purse strings and steps up its investment in new products. Previously it had targeted ‘broadly flat’ costs in the second quarter.

The firm still hasn’t issued any formal earnings guidance for the year to next March, saying in July it saw ‘a range of outcomes and a level of uncertainty around the extent or re-imposition of lockdowns, government action to support economies and the shape of economic recovery’.

However, today’s update is likely to lead analysts to upgrade their first half if not their full year forecasts and revise their price targets, most of which are below the current share price.

Shore Capital’s Robin Speakman said ‘We will consider this revised guidance and upgrade out forecast thoughts accordingly. We retain a Buy stance reflecting Experian’s strategic position in data management and services provision’.