A bounce back of 7% in Ferrexpo (FXPO) shares today will come as little consolation to shareholders after a troubled week for the Ukraine-focused miner.

There was initially good news for investors after the firm hiked its annual dividend by 40% last Tuesday despite a fall in profits in its delayed full-year results.

But such cheer was soon replaced with despair for shareholders when Deloitte abruptly resigned as the company’s auditor on Friday, saying it was unable to establish whether or not Ferrexpo’s co-founder and CEO Kostyantin Zhevago controlled a charity being investigated over its use of company donations.

READ MORE ABOUT FERREXPO HERE

Ferrexpo’s results had been delayed twice pending an investigation into its charitable donations in Ukraine.

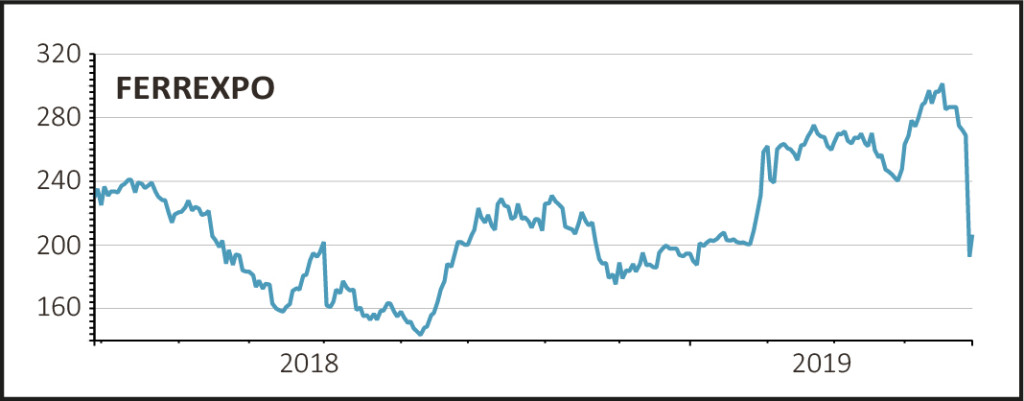

The miner lost almost a third of its value in Friday trading, with shares falling from 272p to a closing price of 192.6p.

Shares have since rebounded to around 206p, and while Ferrexpo has been praised by some for its transparency with the issue, the fall from Friday’s opening share price shows investors are placing more focus on good structural corporate governance.

CHARITY FUNDS 'MISUSED'

Deloitte was concerned that around $33.5m in donations made by Ferrexpo to Ukrainian medical and social services charity Blooming Land in 2017 and 2018 ‘may not all have been used for their stated purpose’.

Blooming Land coordinated Ferrexpo’s corporate social responsibility (CSR) programme in Ukraine, and the company suspended payments to the charity in May 2018 when the issue came to light.

It set up an independent committee, assisted by forensic accounts BDO, but Deloitte said Ferrexpo delayed starting the investigation. The company this morning defended its timing.

Reports suggest Ukrainian prosecutors are investigating whether Blooming Land was used to launder money and evade taxes. Ferrexpo has insisted it doesn’t control Blooming Land.

METEORIC RISE

While the small-cap company has fallen away somewhat having once been a member of the FTSE 100, its stock has enjoyed a meteoric rise in the last few years, jumping from a price as low as 16p in January 2016 to around 296p two weeks ago.

Part of its success has come from the surge in demand for iron ore, with Ferrexpo one of the world’s biggest producers of high-grade pellets.

Demand for iron ore pellets globally has outstripped supply this year, and continues to grow. Major steel producers are increasingly looking to reduce the carbon intensity of their production, significantly raising demand for the high-grade iron ore pellets produced by the likes of Ferrexpo.