Big data investment and applications continue to pay-off handsomely for County Down-based First Derivatives (FDP:AIM).

After a knock-out 12 months last year (to 29 February 2016), half year figures to 31 August are just a muscular. You can read the detailed figures here, but they are summarised below:

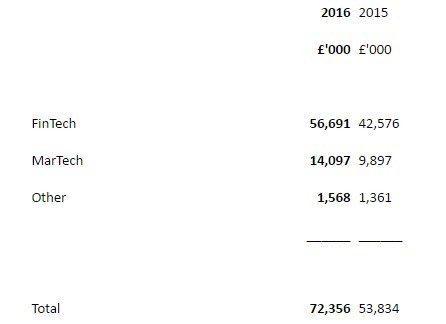

But a really interesting bit comes right at the very end of the notes, where First Derivatives breaks out an industry revenue split, the first time it has done so.

In the past a financial markets supplier - banks, brokers, hedge funds etc - this shows how rapidly the company is expanding beyond its roots, 42% growth in digital marketing versus still impressive 33% fintech.

The 'Other' bit is largely smart grid/smart metering analytics at the moment, although the company has its eyes on various new verticals also.

Shares in First Derivatives are rallying today as investors chew over these figures and facts, up more than 5.5% to £20.85. That's 37% up since we wrote our First Derivatives doing not talking 'big data' story way back at the start of the year.

That puts the current year PE at 34.6, or a more meaningful 31.5-times next year's forecast 66.2p EPS, according to N+1 Singer forecasts.