Popular green investment fund JLEN Environmental Assets (JLEN) wants shareholders to back plans for an expanded investment strategy. The rough £630 million investment trust hopes to widen its remit so it can target new technology assets in the clean, green space, such as battery storage projects, low carbon farming and bioenergy supply chains.

The new rules would also allow it to invest in projects in more places overseas.

‘The proposed changes to the company’s investment policy seek to reflect the growth of the environmental infrastructure market during the period since the company’s IPO and the expected continued development of that market in the future’, the trust said.

JLEN raised £160 million when in floated on the London stock market in March 2014. At the time it invested largely in UK-based renewable energy, waste and wastewater projects. However, its existing remit bars the fund from investing in projects located in countries outside OECD membership, the Organisation for Economic Co-operation and Development, an international organisation that works to build better policies for better lives.

‘The revised investment policy would, if approved by shareholders, allow the company to invest in member states of the European Union which are not members of the OECD,’ the trust said.

JLEN plans to hold a shareholder meeting to approve the investment policy changes next month. There will also be proposals presented to hike the directors pay ceiling from £300,000 a year to £400,000, and allow directors from outside the UK to be appointed.

The shareholder meeting will take place on 8 March 2021.

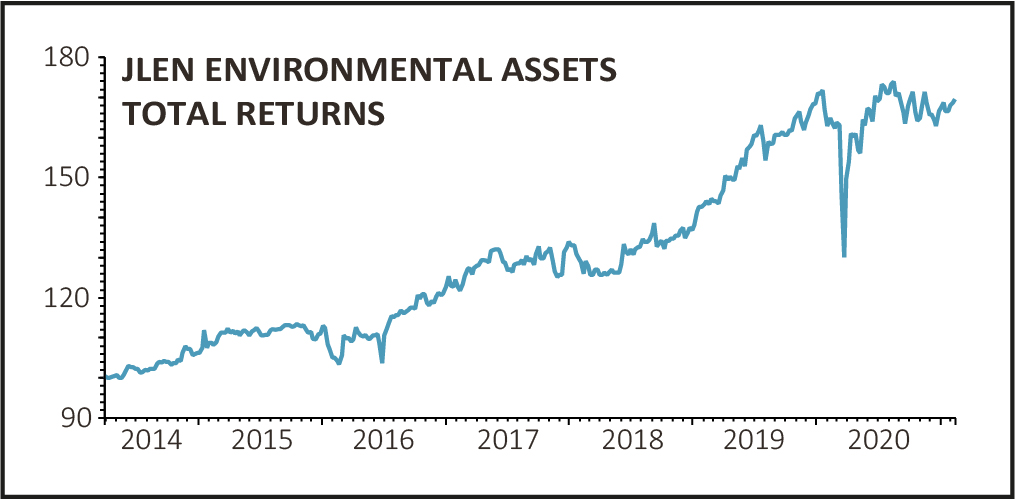

JLEN stock, which nudged 0.5% down to 115.45p, has largely tracked the Investment Trust Renewable Energy Infrastructure benchmark. It marginally underperformed over five years, but modestly beat over the past three.