Gym Group (GYM) has revealed a sharp rise in sales and earnings last year driven by rising numbers of subscribers after the firm lowered prices at a third of its sites.

Sales at the budget gym operator increased by 35% to £123.9m and adjusted pre-tax profit rose 19% to £14.4m in the year to 31 December.

READ MORE ABOUT GYM GROUP HERE

The firm also gave an upbeat outlook after seeing a strong start to the year with membership numbers up 9.5% to 793,000, helping the shares accelerate 6.2% to 215p.

LOW COST GYM MARKET TO DOUBLE IN SIZE

According to analysis by PwC, the overall UK low-cost gym market is expected to roughly double from around 700 sites to 1,400 in the next seven years, implying a growth rate of 10% per year.

With 158 sites at the end of last year, Gym Group has a 24% share of the UK low-cost gym market and is confident it can open 15 to 20 new sites this year to maintain its market share.

The company is trialing a small box format gym, located in a smaller catchment area than normal with between 25,000 and 60,000 inhabitants. If successful more will be rolled out later in the year.

‘A small box format gym is another exciting development and shows the continual evolution of Gym Group and lowering of development costs, which continues to shape the industry,’ says Liberum analyst Anna Barnfather.

As well as using new openings to drive growth, it is rolling out its LIVE IT membership which allows members to bring a friend, gain access to multiple sites and enjoy special offers.

The company is also rolling out a new operating model to attract and keep the best personal trainers working at its gyms.

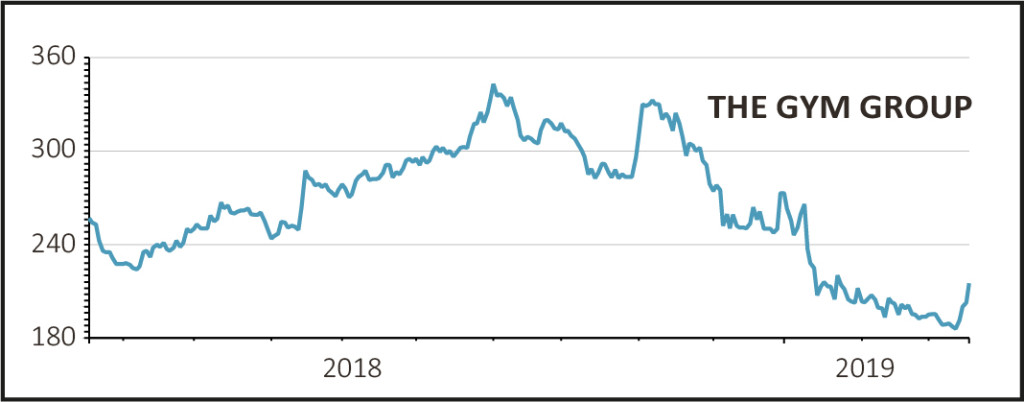

While the market growth potential looks promising, shares in Gym Group are trading well below their highs of over 300p last November.

RBC Capital Markets analyst Julian Easthope says Gym Group has to maintain its speed of new openings to restore market confidence in its strategy, but he remains bullish on its low-cost model.

‘We believe there is a relatively high barrier to entry with Gym Group having efficient technology-based operations, cost effective ‘cookie cutter’ build-out and scale benefits on marketing in local clusters,’ comments Easthope.