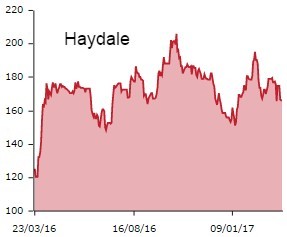

Haydale Graphene Industries (HAYD:AIM) has reported a 90% surge in revenue to £1.5m in the first half, up from £0.8m in the first six months of 2015.

Despite a decent set of numbers and strong test results from its partner Huntsman concerning its Araldite resin, investors are struggling to get excited as the stock nudges 0.2% higher to 166.4p.

Haydale's plan is to adds graphene, a strong carbon compound, to materials to improve properties such as strength and conductivity, and sell these to industrial companies.

In November, Haydale struck an exclusive joint development deal with Huntsman to provide a master batch of graphene-enhanced resin, which will be commercialised by the latter.

The company, which does not manufacture graphene itself, is confident it can afford to buy raw materials for the deal. The company could have sidestepped these costs through a partnership, but would have had to give up its intellectual property, which it decided to protect.

STRONG COMMERCIAL PROGRESS

The market shouldn’t overlook New-York based investment company Everpower’s recent move to take a 9.9% stake in Haydale for £3.26m ahead of an exclusive agreement to manufacture, supply and market its products to the Chinese market.

Everpower specialises in integrating new technologies in China.

Broker Cantor Fitzgerald analyst William Game is optimistic about Haydale’s strong commercial progress as it works closely with ‘potentially very significant partners.’

He comments: ‘The joint development agreement with Huntsman will see Haydale launch its graphene enhanced Araldite resins in the second half of 2018, albeit following delays in customer sampling.'