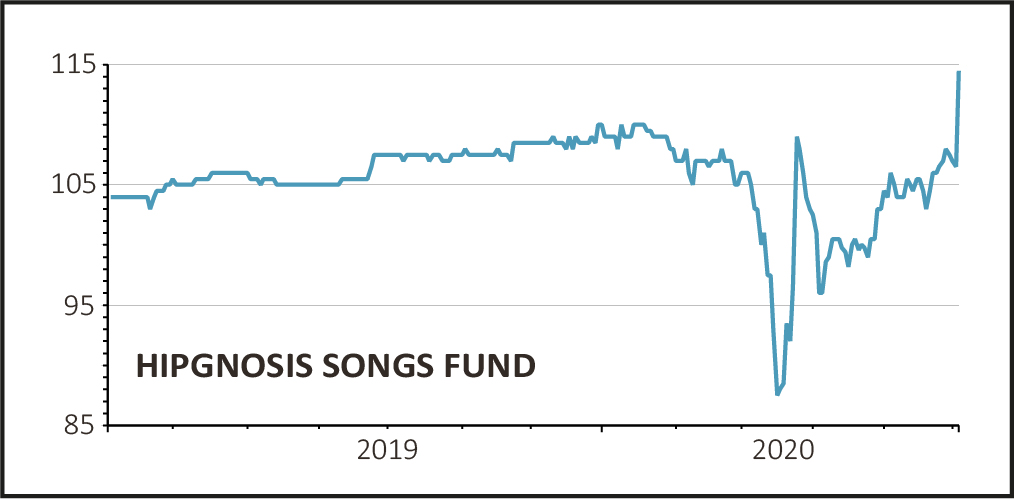

Shares in music royalty investment company Hipgnosis (SONG) jumped 8% to a new all-time high of 115p after it revealed a sharp increase in net asset value (NAV) for the year to 31 March on an unaudited basis.

Using its own calculations, the firm - which owns the rights to songs from artists as varied as AC/DC, Adele, Rihanna, Bruce Springsteen, Justin Timberlake and Amy Winehouse - generated a total NAV return of 17.7% including dividends paid, and a 13% increase in ‘operative’ NAV to 116.7p.

DON’T STOP THE MUSIC

The growth in operative NAV is primarily due to an 11.4% rise in the value of the portfolio of songs since the time of acquisition, together with a reversal in the negative foreign exchange effect as the pound weakened against the dollar in the closing stages of March.

In its first full year since listing the firm has acquired 42 music catalogues for £560m, taking its total repertoire to 54 catalogues. In the same period it has raised £423m of new equity to part-finance the purchases.

Revenues from the catalogue were £64.7m which was ahead of management’s already ‘strong expectations’, generating earnings per share (EPS) of 10.7p.

Out of distributable earnings, the firm is paying a full year dividend of 5p per share, making Hipgnosis one of the highest-yielding stocks in the FTSE 250 before today’s pop in the share price.

LOVING LOCKDOWN

‘We are very excited about these results and we are particularly proud that everything we have promised our investors over the last two years has either come to fruition or been exceeded’, said founder Merck Mercuriadis.

‘A core part of our thesis is that song revenues are uncorrelated as, whether in good times or challenged, music is always being consumed. While we would not have wished for a pandemic to demonstrate this it has indeed done exactly that and that has been reflected in our strong performance’, he added.