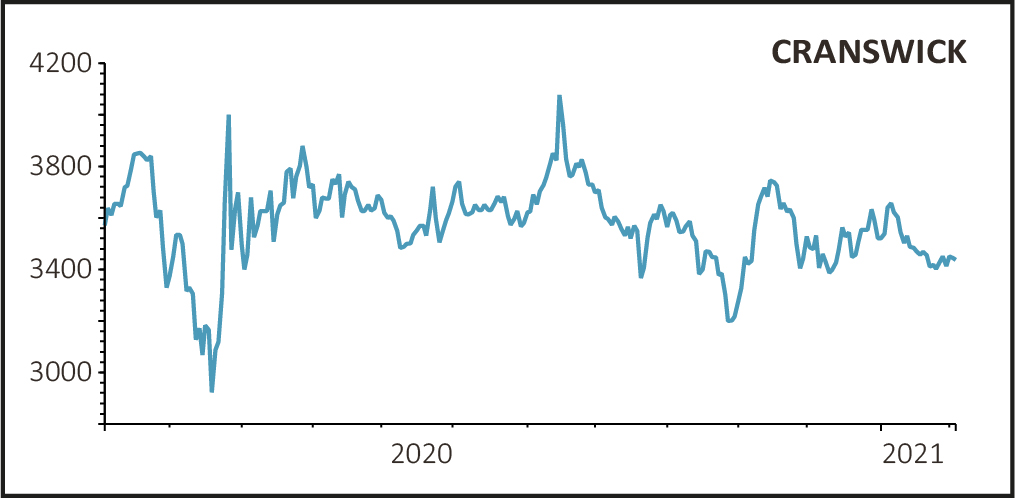

UK food producer Cranswick (CWK) saw analysts up forecasts for the current year after strong revenue and earnings growth continued through the third quarter.

Numis lifted its pre-tax profit estimate for the 12 months to 28 March 2021 by 6% to £123 million, reiterating its confidence in future growth. The new forecast is roughly 5% above the previous consensus of £117 million.

Shore Capital was similarly positive, calling Cranswick a ‘high-quality operator’.

This implies impressive revenue growth of around 20% year-on-year to £1.8 billion.

Cranswick stock rallied nearly 3% to £35.30.

HOME COOKING SHIFT

The lockdown induced shift to in-home consumption meant that UK retail demand remained strong resulting in robust festive trading ahead of the prior year.

The board believes the shift towards greater in-home consumption will continue for the rest of the current financial year providing a demand tail wind for its products.

Cranswick has a consistent record of investment in its processing facilities to improve efficiency, build scale and meet future demand. New capacity at the Eye poultry facility will come on stream in the final quarter, increasing weekly processing by 27% to 1.4 million birds.

In addition, a new £30 million Cooked bacon facility which will supply McDonalds is progressing according to plan with commercial production expected to begin in the first quarter of the new financial year.

GREEN CREDENTIALS

The company is also upgrading its energy efficiency by installing solar panels and self-generating electricity while sourcing 100% of the group’s electricity from renewable resources.

On 18 November the company’s Milton Keynes site was its first to be awarded the Carbon Neutral certification.