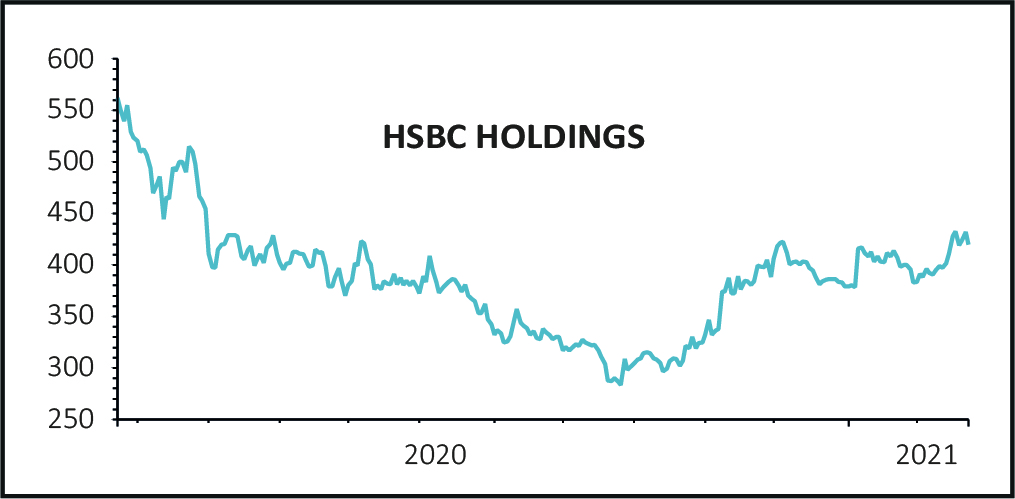

Despite posting a better-than-expected performance in the fourth quarter of last year and signalling a return to dividend payments, the UK’s largest bank by market value HSBC (HSBA) still saw its shares fall 2% to 422p in early trade.

Pre-tax profits for the year were down 34% to $8.8 billion, impacted by the twin effects of a 10% fall in revenues due to continued low interest rates and a large hike in provisions for potential credit losses due to the pandemic.

On a positive note, the bank swung to a net profit of $562 million in the fourth quarter against losses of $5.5 billion the previous year and expectations of a $115 million net loss.

The Global Banking and Markets business performed ‘particularly well’, according to chairman Mark Tucker, while Asia was once again ‘the most profitable region by far’ as China exited the pandemic early and its economy staged an impressive recovery.

The bank hinted strongly that it would shift its medium-term focus towards Asia, with the aim of becoming the market leader for high net worth and ultra-high net worth clients in the region as well as investing to capture trade and capital flows through its global markets division.

However, there was no detail on what it had planned for its sub-scale US operation or its French business, which has been on the block for some time.

Also, the persistent low interest rate environment led the bank to abandon its target of a return on tangible equity (ROTE) of between 10% and 12% by the end of next year. Instead, it said it would seek to achieve a return of ‘greater than or equal to 10% in the medium term’.

Even the dividend was underwhelming, with the interim payment set at just 15c per share compared with a pre-pandemic level of 50c per share and no buybacks to bump up the total shareholder return.

The bank will also stop offering a scrip dividend option for those who would rather receive shares instead of cash.