Ten-pin bowling operator Hollywood Bowl (BOWL) reported better than expected full year operating profits to 30 September of £28.4m, up 14.3%, 5.5% like-for-like revenue growth and said it would pay a special dividend of 4.5p.

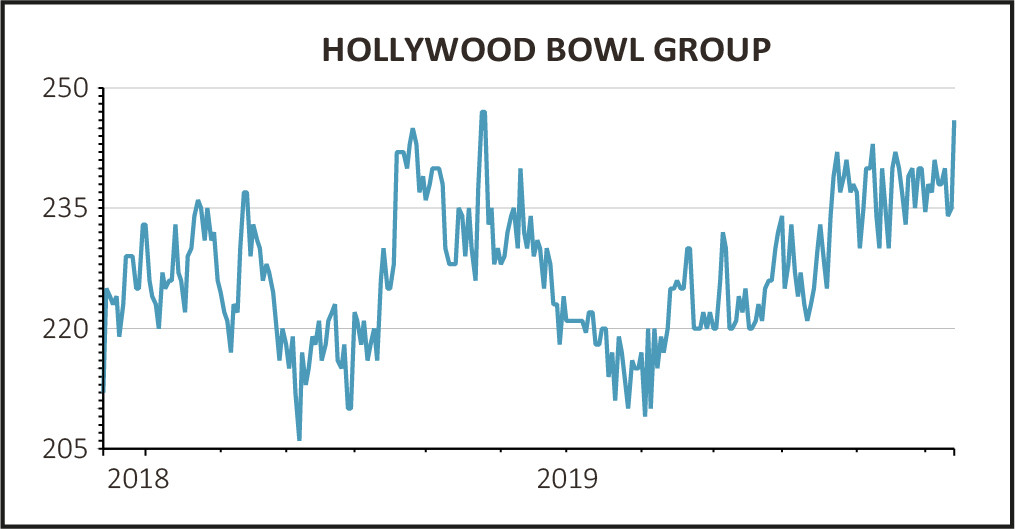

The shares traded 7% higher to 251.5p.

HIGH CASH PAYOUTS

In addition to the special dividend the company is paying a full year dividend of 7.43p per share, up 18.7%, equivalent to a yield of 4.75%. Since floating on the stock market the company has returned £47.7m to shareholders, which represents approximately 20% of the market capitalisation.

Total shareholder return, which includes dividends and capital gains, is 79% in a period of just over three years, a compound average growth rate of 21%.

Chief executive Stephen Burns commented, ‘we have made a solid start to the new financial year and we expect to make further progress in our ongoing refurbishment programme, investment in technology and continued roll out of customer innovations. I am confident that we will continue to deliver value for all of our stakeholders.’

STRIKE IT RICH

Strong like-for-like sales were driven by growth in all the key metrics with game volumes up 3.1%, bowling spend per game up 2.6% and ancillary revenue up 3.1%, resulting in a combined overall spend per game up 4.6% to £9.22 (£9.64).

The company operated from an additional two sites, (3%) bringing the total to 60 national wide venues, and steering revenues up 7.8% to £129.9m.

Strong cash generation is a feature of the business as it converts nearly 20% of revenues into operational cash. Despite spending £8m on expanding the estate, Hollywood Bowl delivered £14.7m of free cash flow, enabling the payment of the special dividend.

How a company allocates capital is very important for shareholders and the management of Hollywood Bowl are very clear in this regard. They prioritise capital spending on the existing estate and growing new centres while paying-out a dividend that is two times covered. Any excess cash thereafter is available for additional distribution to shareholders.

The company is targeting to refurbish seven to 10 centres in the next financial year as well as opening another bowling site and three mini-golfing centres. There are six further bowling sites in the development pipeline over the 2021 to 2023 period, securing future growth.